Our new Global Telecommunications Study has identified eight key growth trends for telcos. Divided into a three-part blog series, the study explores how these realities will shape the future of the telco industry and the related solutions for companies to thrive. In Part 1, we explore insights into four growth drivers focusing on brand, portfolio, and pricing.

The global telecommunications industry relies on various performance drivers in 2024. We have tracked down the eight fundamental growth topics necessary for your sustainable growth this year. In this article, we explore the first four growth drivers that fall under “brand, product portfolio, and pricing.”

The price-value relation and why it matters for your brand

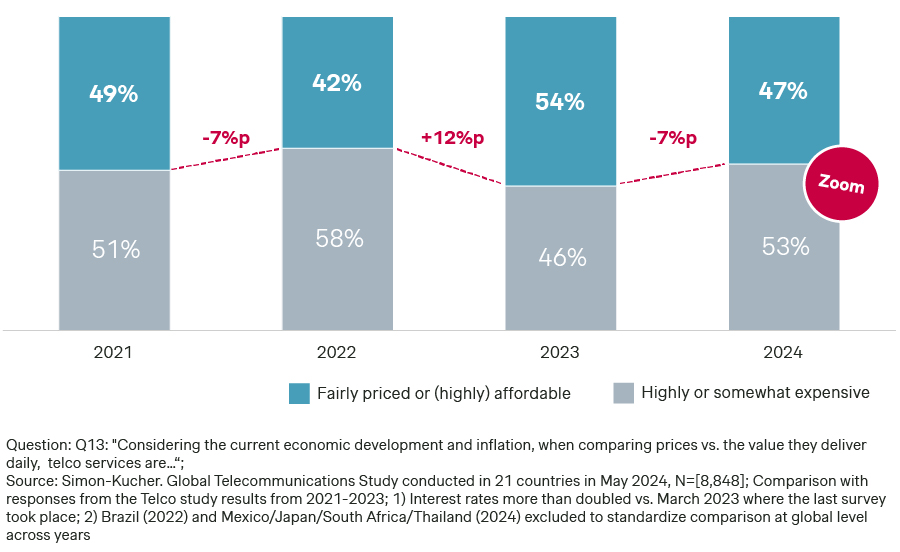

The price-value ratio is an important measure of the alignment between your product prices and customer-perceived value. Understanding the correlation between price and value and striving to improve this ratio is essential to improve customer satisfaction, identifying the optimal pricing strategy and improved profit margins. Our research shows a 7 percent decline in the price-value ratio in telco, suggesting that telco prices no longer reflect the same value as last year. This decline emphasizes the need for initiatives focused on improving the price-value ratio.

The telco industry provides critical services to millions worldwide. From personal consumption to business enablement, telco network services are a key utility, driving connectivity and growth at a global scale. The pandemic years boosted demand, but growth has now slowed. Recent macroeconomic headwinds have compelled 43 percent of respondents to reduce their telco spending, primarily through downgrades and switching providers.

So, how can telco businesses improve margins in 2024? Your telco business needs to identify unique value differentiators and leverage them as strong performance drivers.

However, before focusing on growth strategies, prioritize understanding your business's offerings and the price-value ratio. Customers should feel they are getting good value for their money and your brand should be making the right moves to monetize your offerings effectively.

Four key trends to improve telco brand, portfolio, and pricing

The first four growth trends focus on increasing customer satisfaction, thus improving your brand’s price/value perception.

Brand positioning as an intangible value differentiator

Telco providers must distinguish their brand by examining their brand positioning and emphasizing intangible value differentiators.

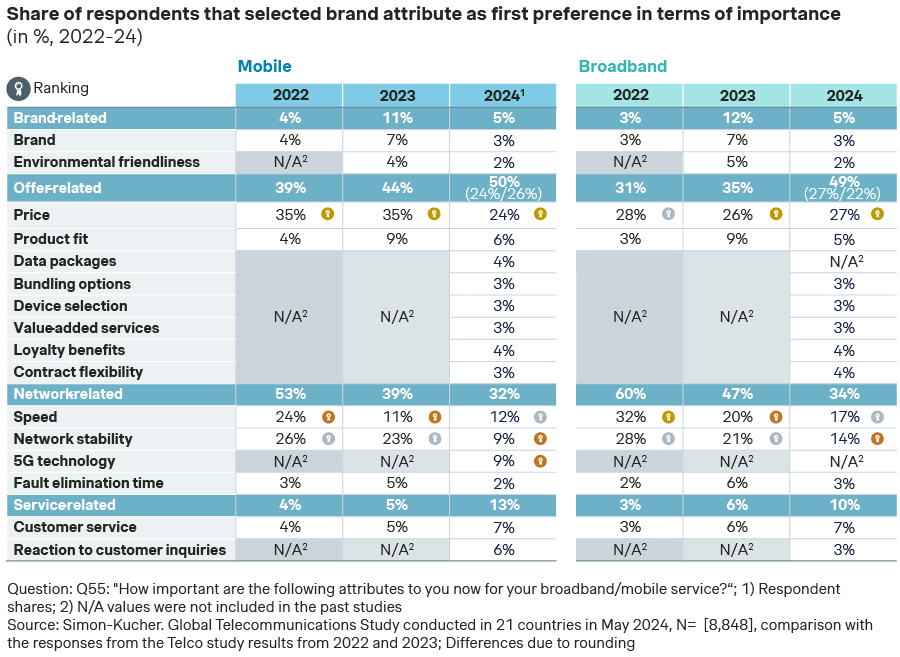

Our research shows that offer-related criteria now make up 50 percent of purchase decisions. Price remains highly relevant, especially among customers of non-incumbent players, but its importance has declined compared to overall “value for money.” Mobile and broadband customers now prioritize brand attributes like price, internet speed, and network stability

Our study indicates the rising importance of value differentiators, like network and customer service, that are key to building a stronger telco brand.

New opportunities in the “post-unlimited” era

What are the tangible value differentiators telcos can use in the ‘post-unlimited era’?

Data volume- vs. speed-based rate plans

One big trend we are witnessing is the continuous rise of unlimited tariffs. But what monetization levers will telcos have in approximately five years when the market is already saturated with every telco provider broadly offering unlimited data rate plans (the so-called “Endgame Unlimited”)?

While unlimited rate plans generate around 40 percent higher ARPU, telcos must plan for a future where these plans are no longer a key brand differentiator.

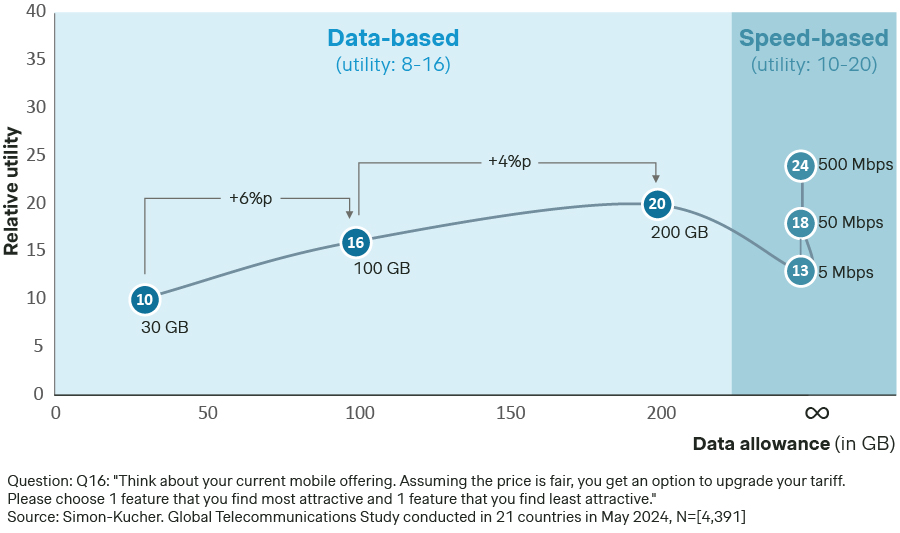

This is where speed-based rate plans come in. Instead of monetizing by data volume, telcos can differentiate by speed. Already, half of all countries show a preference for speed-based alternatives, with North America and APAC leading with over 60 percent of customers on unlimited plans.

For those telcos that are hesitant to make a full transition, hybrid models that combine speed and volume are an option to add more value to their offerings. Our research indicates that increasing GB tariffs may not significantly boost interest as the added value beyond 100GB is minimal. In comparison, increments in speed levels clearly add more value to the bundle. Already a 5Mbps rate plan has a higher utility than a 30GB alternative.

Device-as-a-Service (Daas)

Telcos currently underutilize handset monetization, with less than 50 percent of the handset market currently being monetized through subscription options. Consumers keep their smartphones for longer due to fewer innovative updates, increasing prices, and environmental concerns. At the same time, flagship smartphones retain about 50 percent of their value after the first year and 40 percent after two years, presenting significant refurbishment opportunities.

DaaS offers an average upselling potential of 6-30 percent (average across 21 countries), allowing telcos to address new customer segments, deliver a complete service ecosystem, promote specific packages, and facilitate the resale of trade-in handsets to third-party providers.

The right VAS as business model innovation

The global market for mobile value-added services (VAS) is projected to reach €1,043 billion by 2029, growing at 7 percent per year. To capitalize on this significant growth opportunity, providers need to carefully select the right value differentiators for their telco portfolio and customer base. Telcos can improve cross-selling by integrating relevant VAS, such as cybersecurity, premium speed, storage backups, WIFI extenders, and optimizing their bundling strategies.

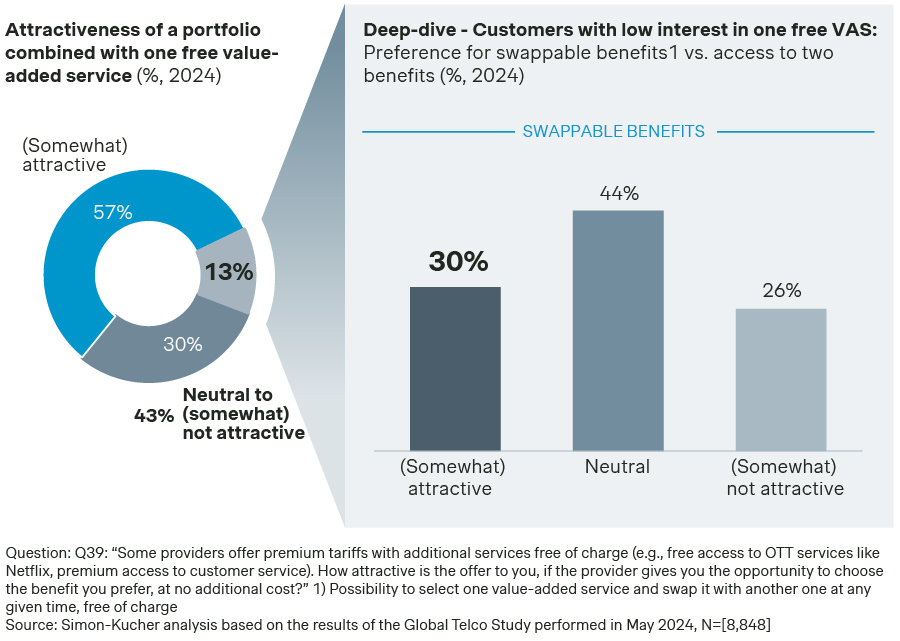

Our study reveals that for three out of five respondents the portfolio attractiveness increases if they can obtain an additional benefit for free. However, of the approximately 40 percent of customers that have “neutral to low interest” in one free VAS, 13 percent can be convinced if a swappable benefit is offered.

Choosing the right VAS reduces complexity for the customer and increases attach rates. Customers show a clear preference for streaming and music services when purchasing VAS subscription options. Additionally, one-third of customers subscribe to regional/local OTT players, which telco players should consider offering.

Navigating price perception in competitive telco markets

Macroeconomic conditions have impacted telco spending, with more than 40 percent of consumers reporting changes in their spending habits. Interestingly, inflation doesn’t have a big impact across the 21 countries covered in the study. For example, Thailand experiences low inflation (3.9 percent) but significant impact on telco spending (57 percent), whereas Poland has high inflation (11.5 percent) with less effect on spending (37 percent).

Big telco companies are increasingly facing pressure from budget players, as they increasingly lose some of the differentiators they used to own to mobile virtual network operators (MVNOs). Budget brands are stepping into the area typically dominated by premium players, such as 5G networks, which have been key service differentiators in the telco industry. Premium players need to reclaim these service differentiators to avoid losing ground to MVNOs.

To offset this price pressure, telcos could develop attractive portfolios and improve the perception of price increase initiatives. This may be achieved by better communicating the value of their services and implementing differentiated pricing strategies. Enhancing your telco portfolio with value-added services that cost little or nothing to your business can increase perceived value without reducing prices.

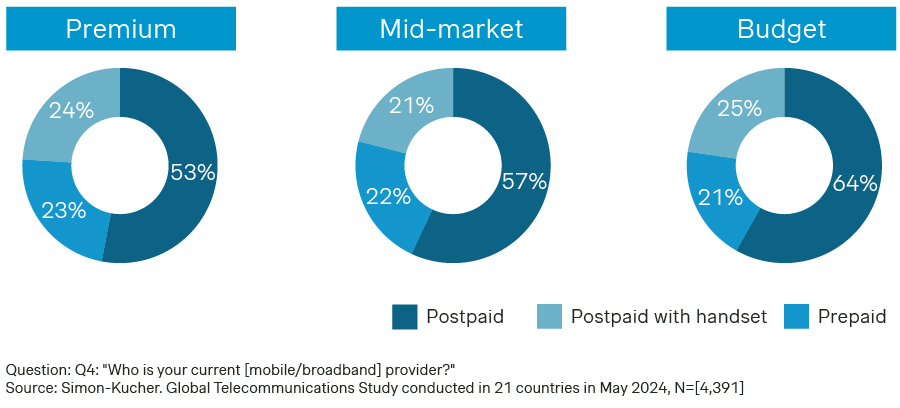

Budget brands focus on the prepaid segment where the global prepaid ARPU is €25.50. Premium players have largely abandoned this market as prepaid ARPUs are - on average - one-third lower than global post-paid (€37.70).

There is still a demand for prepaid plans as they offer flexibility and meets the needs of conscious consumers. Premium players shouldn’t completely neglect prepaid packages and aim to transition pre-paid customers to post-paid through hybrid contracts or by offering prepaid-like services to reach customer groups they might otherwise miss.

Simon-Kucher price/value frameworks to optimize telco commercial levers

Customer needs and expectations are changing, and in today’s highly competitive market, improving brand image, portfolio value, and pricing strategies are essential for long-term growth. At Simon-Kucher, we have two proven frameworks that help telcos enhance their commercial performance:

ICE Model: Our ICE Model improves a telco’s brand image through three key levers – image, communication, execution – across different customer perception stages. This framework provides actionable insights on intangible levers that influence customer perception.

Portfolio Innovation Framework: With our Portfolio Innovation Framework, we have helped our telco clients develop innovative, value-driven portfolios for better margin impact. This framework uses five levers to optimize brand value and image: disruptive portfolio innovations, core and non-core portfolio elements, improve price/value perception, increase up- and cross-selling, and optimize take rates.

Our team of experts utilize these frameworks to help telco clients strengthen brand image, optimize service offerings, and achieve better commercial outcomes.

Download our ICE Model and Portfolio Innovation frameworks for free.

Read the full Telco 2024 Study Report here.

If you would like to discuss our study results in more detail, reach out to us today.