Private labels are becoming prevailing players in the food and drugstore markets. With over half of consumers preferring private labels, manufacturers must adapt to evolving consumer behavior. We delve into Simon-Kucher's latest shopper study, revealing key strategies for pricing, category management, and operational agility to help manufacturers grow in the dynamic retail sector.

In recent years, private label products have shed their budget image, becoming more sophisticated and competing with name brands in both quality, sustainability, and packaging. This shift is particularly evident in the food and drugstore sectors, where private labels are not only increasing their market share but also fundamentally altering consumer purchasing behavior.

Simon Kucher's 2024/2025 shopper study on food and drugstore products, based on 8,000 consumers across seven countries (Germany, Spain, France, The Netherlands, Sweden, the UK, and the US), provides key insights into the factors driving private label adoption. The report also examines the impact of economic trends and inflation on purchasing behaviors and highlights actionable strategies for private labels looking to grow sustainably.

The ascendancy of private labels

Our study reveals a significant shift in consumer preferences toward private label products: over half (53 percent) of respondents choose private labels either predominantly (32 percent) or exclusively (21 percent) over branded products. This trend is most pronounced in Spain (64 percent), France (60 percent), and the Netherlands (58 percent), where consumers report purchasing private labels almost exclusively (25-27 percent).

In contrast, the United States (42 percent) and Sweden (47 percent) have lower adoption rates, suggesting significant growth potential. Germany stands at 52 percent, indicating that private labels continue to gain traction.

Price sensitivity: The primary purchase driver

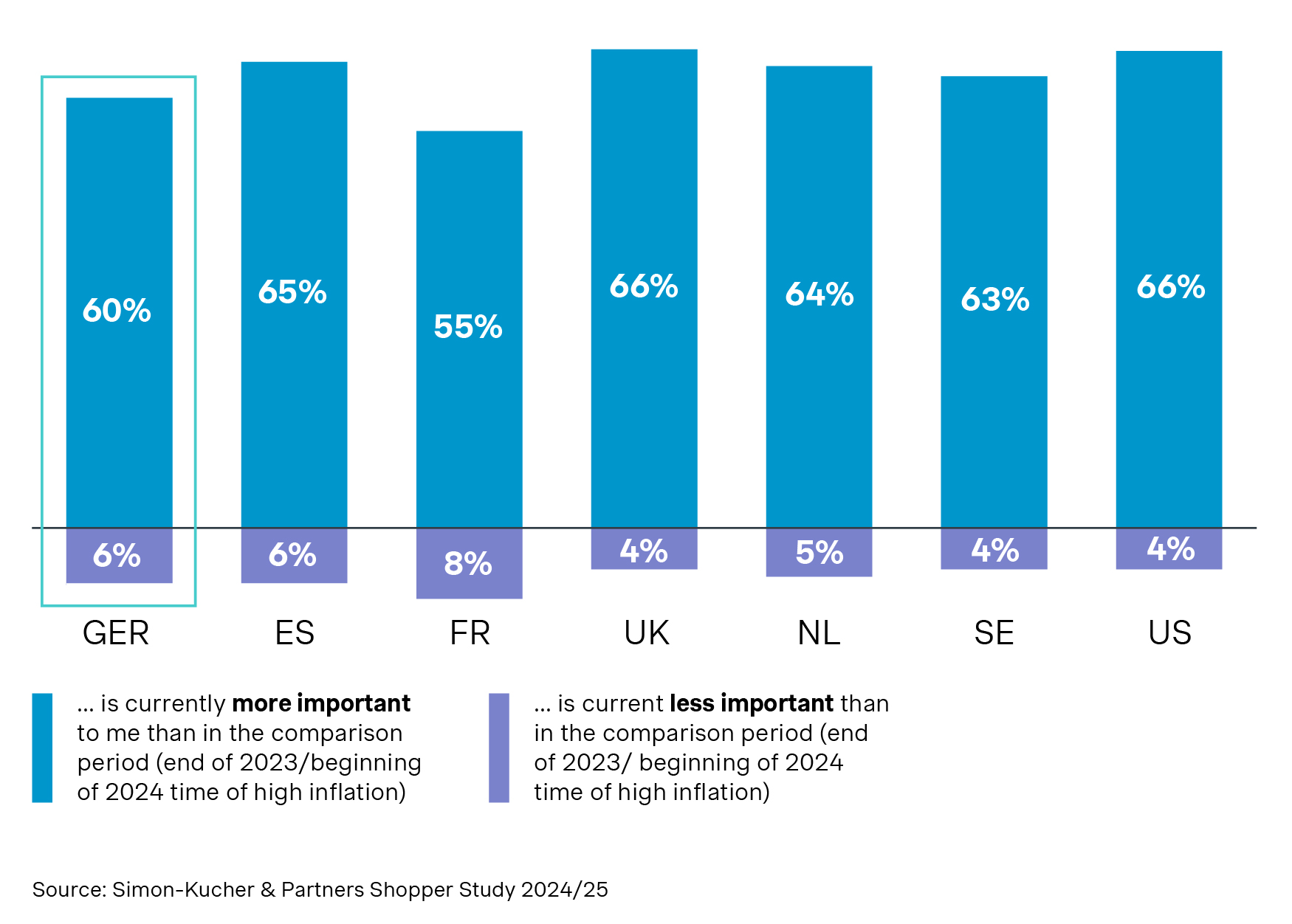

Despite a decline in inflation in late 2023/early 2024, price remains the top factor influencing purchasing decisions. Between 55-66 percent of respondents across all surveyed countries state that price has become even more important, especially in the UK, the US, and Spain (65-66 percent). This indicates that high prices for food and drugstore products continue to shape consumer behavior. Private labels, which are favorable compared to brands in terms of pricing, are thus better positioned to attract price-conscious consumers and gain further market share.

Interestingly, only around 5 percent of respondents reported that price had become less important, reinforcing the idea that private labels offer a compelling value proposition amid persistent price sensitivity.

What happens if prices fluctuate?

Our shopper study examines how price changes impact private label purchasing behavior:

- If prices increase, more than 50 percent of respondents would turn even more to private labels, with the highest percentages in the Netherlands (58 percent), Spain (56 percent), and the UK (55 percent).

- If prices remain stable, between 63 percent (the US) to 74 percent (Germany) of respondents would maintain their private label purchases, while 12-18 percent would buy even more.

- If prices decline, about 30 percent of respondents indicate they would return to branded products, with the highest share in Spain (42 percent). However, Germany (24 percent) and the UK (26 percent) show a more stable preference for private labels. Notably, amongst the age group 18-24 years, 17 percent of shoppers would even increase their private label share as they are increasingly making purchasing decisions based on factors other than price (quality/sustainability).

This suggests that, while private labels have gained strong consumer loyalty, pricing still plays a critical role in purchasing decisions.

Quality perception: A new competitive advantage

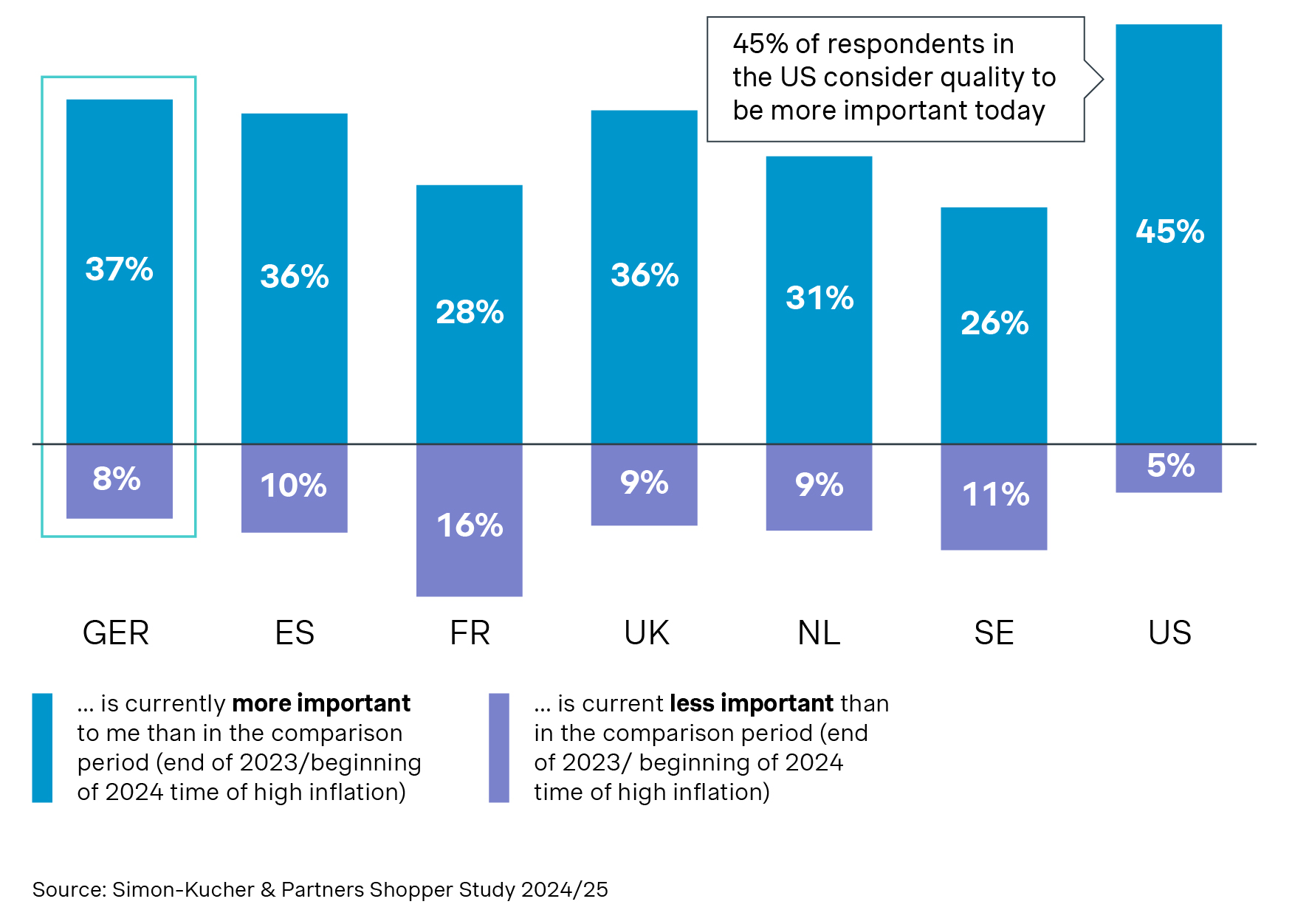

Although price remains the top driver, quality perception is gaining significance. On average, 34 percent of respondents place greater importance on quality compared to the previous year, with the US (45 percent) and Germany (37 percent) reporting the highest increases.

This trend suggests a "habituation effect" — with consumers becoming accustomed to higher prices, they now place greater emphasis on product quality rather than just seeking the cheapest options. This opens opportunities for private label manufacturers to enhance their reputation by offering high-quality alternatives to branded goods. Many private label companies are therefore increasing their focus on effective category management. They no longer just provide entry-level price products but now cover a broad spectrum of price and quality levels, catering to a wider range of consumer needs. This proactive category management approach is immensely appreciated by their retail partners.

Sustainability: A growing consumer expectation

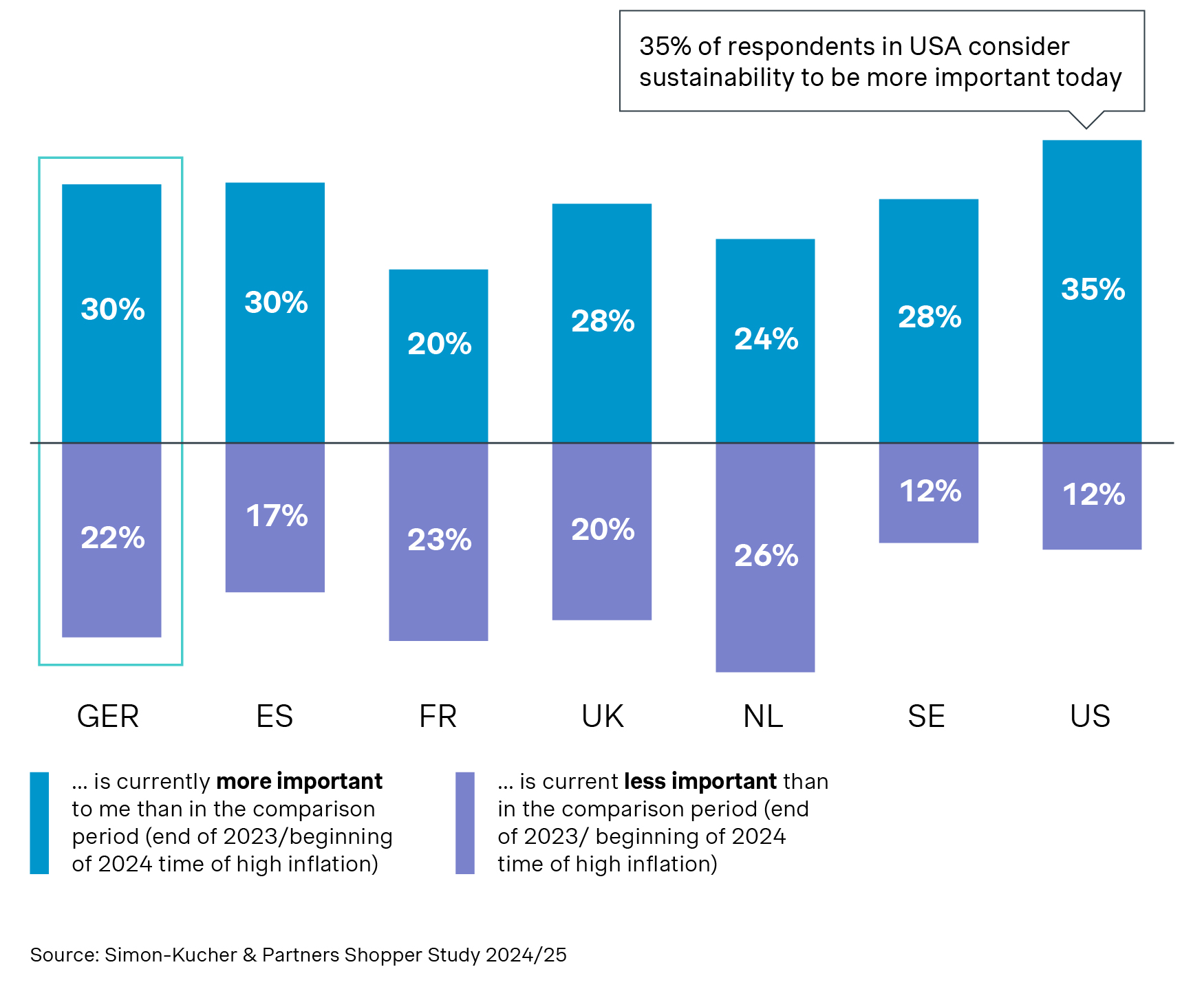

Sustainability is increasingly influencing purchasing decisions, particularly among younger consumers. On average, 28 percent of respondents say sustainability has become more important when choosing food and drugstore products.

Country-specific data shows notable differences: sustainability importance is highest (~30 percent) in Germany, Spain, the UK, Sweden, and the US, but less pronounced in France (20 percent) and the Netherlands (24 percent). However, nearly 20 percent of respondents in all countries indicate that sustainability is losing importance for them, especially in the Netherlands (26 percent).

This suggests a divided consumer base requiring private labels to carefully tailor their messaging and sustainability initiatives.

Strategic imperatives for private label manufacturers

What has applied to the brand for years now also applies to the private label. The following imperatives can help them succeed:

1. Align pricing and portfolio strategy with consumer budgets

Understanding consumer budgets and product value drivers is critical. Private labels must ensure their pricing strategies align with what consumers expect while continuing to reinforce the quality of their products. As a critical aspect of revenue growth management, pricing today requires precision.

2. Strengthen category management & retail partnerships

Private labels should take a proactive approach in category management, leveraging data-driven insights to optimize product assortments. Strong partnerships with retailers can enhance shelf space, drive promotions, and improve overall market positioning.

3. Optimize the sell-in mix for maximum growth

A continuous refinement of product portfolios is essential. They must focus on high-demand categories such as dairy, dry goods, frozen foods, and fresh produce, where private labels have the highest adoption rates. It's also vital to track product categories, such as alcohol and toddler products, where our research shows private label market share has fallen.

4. Maintain operational agility

A lean and agile operational model allows private labels to respond swiftly to retailer and consumer demands. By improving supply chain efficiency, they can maintain competitiveness in a fast-evolving market.

Embracing the future of private labels

Superior quality and competitive pricing have enabled private label products to successfully compete with established brands. As consumer expectations for better value, unique offerings, and ethical sourcing increase, private labels must innovate to make their presence known in the consumer sector.

By adapting to shifting price sensitivity, enhancing product quality, and integrating sustainability into their strategies, private label manufacturers can thrive in the dynamic retail market.

At Simon-Kucher, we help consumer businesses unlock growth opportunities with data-driven insights into pricing, category management, and product strategy. For more insights, download the latest shopper study and contact our sector experts today.

Join 'The Rise of Private Label' webinar

Join us for an exclusive webinar unpacking findings from the EU Shopper Study. We’ll explore how inflation, shifting consumer habits, and new value perceptions are shaping the future of private label.

Form placeholder. This will only show within the editor