The time is right for more Fintechs and the Financial Services industry to adopt usage-based pricing. In our latest article, Hrishi Rajadhyaksha (Senior Director, UK Fintech/FS-tech Lead at Simon-Kucher) and Marek Rubasinski (VP Strategy, Business Development & Partnerships at m3ter) discuss how UBP is uniquely poised to offer a win-win for both buyers and sellers.

Decisions made in business, especially those around pricing, rarely feel like they benefit both sides. If a vendor raises prices, that means the customer has to pay more. If the customer negotiates for a discount, the vendor takes a margin hit.

Finding something that can be a win-win for both buyer and seller is a refreshing change of pace. One such strategy is usage-based pricing (UBP), also known as consumption-based pricing), where customers are charged based on how much they use a product or service.

At the simplest level, UBP can be a win-win because 1) the vendor makes more money as usage scales, and 2) the customer only has to pay for their consumption, which ideally shows them the connection between value received and the price they pay.

Not all industries or companies are suited to UBP, and some are not ready for it yet. However, as UBP adoption in SaaS and other technology businesses has grown over the last decade, financial services firms, including banks and asset managers, are not only uniquely suited to UBP adoption but are also explicitly asking for it from vendors.

Why are Fintech buyers asking for UBP?

The decision to move to UBP is not only a “push” from Fintech vendors hoping to achieve certain benefits (more on this later); there’s also a “pull” from buyers actively requesting UBP for the Fintech products they want to buy. Some of this comes down to the general benefits the buyers will receive from a usage-based model, while other factors relate to this moment in time, highlighting why now is the right time for increased UBP adoption.

1) Updated technology in banks

Over the last two decades, banks have completed a full cycle of replacing old technology with new, as updated regulations come in (e.g. MiFID, the Basel framework, etc.). As more regulations took effect, we saw new technology installations increase accordingly.

Now, that cycle is beginning again, where the technology is again getting outdated and banks are more open to updating their stack, particularly with more cloud-native tech. As this continues, we see a structural shift happening in those banks’ technology departments, which are now more primed to tech vendors charging by usage. The more familiar and comfortable with UBP they become, the more they are ready to actively request it from Fintech vendors after experiencing the benefits.

2) Transparency and simplified procurement

As with most companies, procurement departments in banks are incentivized to get good deals, but their procurement processes (especially in bigger banks) can be quite complicated. In their eyes, usage-based pricing is ostensibly a good deal, because they’ll only pay for usage. But they have also traditionally liked certainty, which typically meant large fixed-fee contracts with lots of padding.

This transparent connection between consumption and price simplifies the procurement process. It also allows for any variability in volumes that may exist in investment banking, wealth management, or asset management without requiring a large, fixed OpEx line item that might sit unused for a period of time. An important consideration, though, is providing procurement teams with predictability of costs within the UBP context (e.g., by creating pre-committed usage bands within the pricing model).

3) Flexibility and testing without large commitment

As frontier use cases develop/mature in Financial Services – from automation of KYC and AML to transaction matching and settlement – buyers want flexibility to test these use cases without spending a huge chunk on technology right away.

Rather than sign an up-front commitment, buyers would probably prefer to see the benefits of the product firsthand. We are also currently seeing this play out in real time with the rise of products using GenAI. For example, trade-tech vendors are experimenting with GenAI-powered “companions” that help generate hyper-specialized documentation like Key Investor Docs (KIDs) based on complex regulation. Buyers may only start realizing benefits (if not immediately clear) when they use the AI product more, making UBP a great hook and a mutually beneficial model.

4) Need for internal cost allocation

Think of all the possible teams that can exist within a bank, particularly a universal bank. There’s the back office, middle office, and front office for the commercial investment banking side; the retail bank; the private bank; a treasury function; perhaps an asset manager, and so on.

Each of these teams will have very different use cases for the same technology, but the buyer may be the same (i.e., a central procurement team). Some of these teams may use the same product, but with different use cases and degrees of usage. UBP makes it easier to attribute the costs to the correct business units.

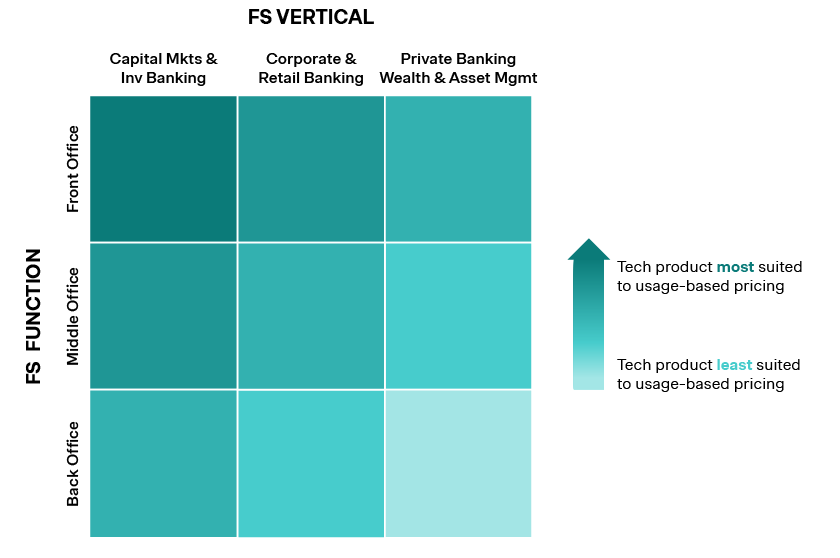

Which part of the Financial Services industry is most primed for UBP?

The usage-based “future” is already here, it’s just not evenly distributed. The spectrum of products and services provided to the Financial Services industry by Fintech and other technology businesses is broad, and the readiness for usage-based models varies depending on the product.

For example, UBP is already the default model in areas like open banking and embedded payments typically sold on an API basis. It’s increasingly becoming the model in other areas like trade-tech within capital markets, and it's starting to be explored in financial data.

Different functions within the financial services industry are more or less primed for UBP adoption. Broadly, here is how the picture looks.

UBP for Fintechs: Why vendors should consider usage models

There are a host of reasons for Fintech vendors to seriously consider usage-based pricing for their products. Not only are the buyers asking for it, but the business environment is primed for it, and UBP can offer numerous potential benefits for their operations and bottom line.

1) Faster organic growth and higher NRR

UBP enables organic account growth by scaling revenue as usage increases. If the product delivers value, customers’ usage and payments should rise accordingly.

Because of this, usage-based companies typically grow faster than companies without a UBP model and have higher Net Revenue Retention (NRR) than those with “pure” subscriptions (i.e., no real growth levers).

2) Tailored deals

This is the other side of the “buyers wanting flexibility” coin. UBP models allow vendors to more easily and effectively tailor deals to each customer, depending on their needs and requests.

Often, this is just about tailoring the package, but in extreme cases, you could even change the metric you charge on if it's a big enough customer who warrants it.

3) Increasing sales by lowering barriers to entry

Vendors selling to Financial Services know it’s not an industry with a huge amount of product-led growth (PLG), especially not in the mid-market and enterprise. But even if that’s true, it’s a lot easier to sell the idea of a usage-based model where a customer can try out the product, rather than asking them to sign a multi-year, multi-million dollar deal.

UBP opens up the ability to make sales or start relationships you may have struggled to form otherwise, all without waiting through a long procurement cycle.

4) Simplifying the buyer’s understanding of value

With products that are suited to usage-based models, the connection between value and cost is usually easier for buyers to understand (and be willing to pay for). For example, the value I receive from the XYZ email app is tied to the number of emails sent, i.e., my usage of the product. Therefore, usage x price per unit of usage = price I pay. Feels fair, right?

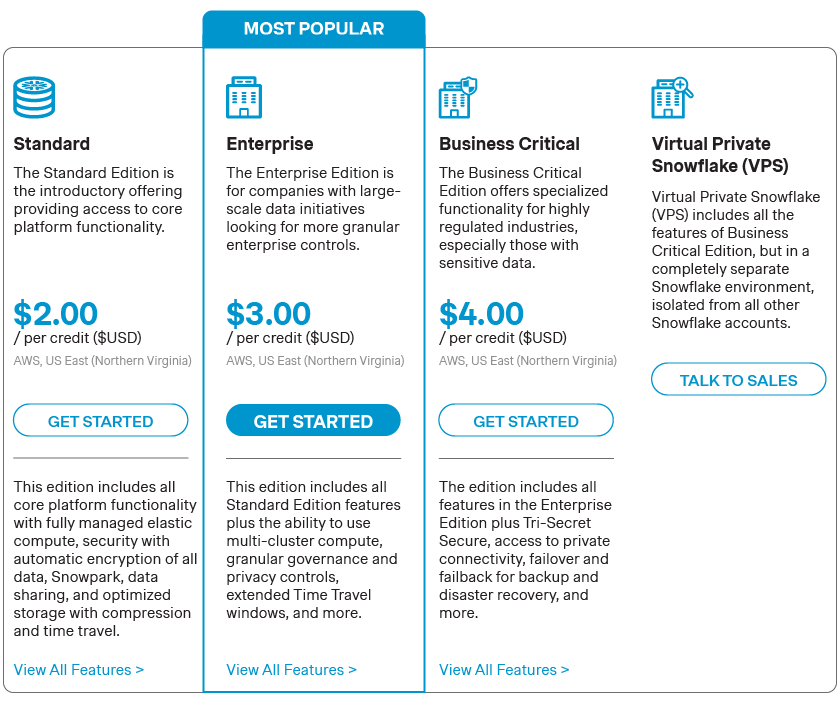

Even where the system is complex or the pricing metric is not so straightforward, other forms of UBP, like credit models, can be used to keep the value/price connection simple.

Credit models can take a variety of forms, one of which is credits as usage, a model popularized by Snowflake (above). If consumption of a product or service is complex, it can be streamlined by converting it into a single unit of measure. Usage is expressed in these credit units, but prices to end customers are expressed in flat currency per unit.

Whether through a credit model or another pricing metric, UBP enables vendors to draw a clear line between the buyer’s usage – and value – and the end price they pay.

Is UBP right for your Fintech business?

Usage-based pricing is not right for every industry, nor is it the best model for every company. But in the case of Fintech buyers and vendors, it could be the perfect combination of 1) right time and 2) an industry (Financial Services) that is uniquely suited to capitalize on the potential benefits of UBP.

Not sure if UBP is right for your business? m3ter’s research and conversations with SaaS experts found that company and product characteristics which lend themselves to UBP include lower-in-the-stack products, other high COGS solutions, products linked to revenue, products capable of usage intensity growth, and self-provisioning products.

As experts in pricing and strategy, Simon-Kucher can help you develop a comprehensive UBP strategy to match your Fintech business needs. We suggest that vendors consider using UBP if/when:

1. consumption is trackable,

2. consumption metric is expected to grow,

3. down-trade risk is low

4. market acceptance is high,

5. there is a clear link to value,

6. there is a clear link to cost, and other methods carry a significant risk of not recovering costs.

In cases where usage-based pricing is a good fit, it’s not an all-or-nothing choice. There’s a whole spectrum between UBP and traditional models, and those hybrid models in the middle are actually even more popular than pure UBP.

With thanks to Marek Rubasinski (VP, Business Development & Partnerships, m3ter) for his contributions to this article.

Contact Hrishi Rajadhyaksha at Simon-Kucher to discuss how usage-based pricing can benefit your business.