As the European Union Health Technology Assessment Regulation (EU HTAR) approaches, are EU Member States ready for its implementation? Our industry experts assess how EU Member States are preparing for the regulation set to take effect in January 2025, and the readiness of national payers, and the key challenges they are currently facing.

Preparing for change: EU Member States strategize for EU HTAR implementation

The European Union Health Technology Assessment Regulation (EU HTAR) 201/2282 will significantly transform how health technology assessments for pharmaceutical products are performed in the EU. It represents an additional step for manufacturers in their European launch preparations. The regulation is designed to promote collaboration and alignment on a common methodology among EU Member States through a Joint Clinical Assessment (JCA), focusing on the clinical evaluation of pharmaceuticals. While encouraging collaboration, the EU HTAR maintains each Member State’s autonomy in making decisions about the added value of health technologies, including pricing and market access (P&MA) within their healthcare systems.

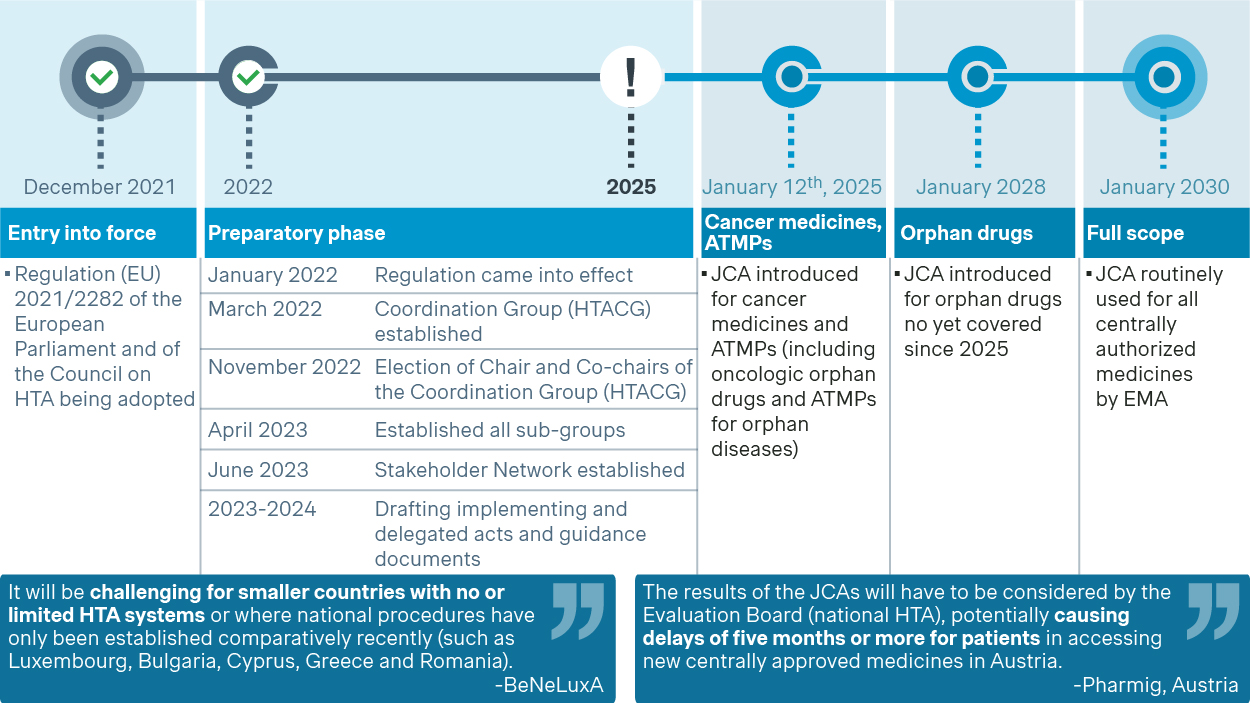

The JCA will be introduced on a rolling basis for products requesting European Medicines Agency (EMA) regulatory approval, starting with cancer medicines and ATMPs (including oncologic orphan drugs and ATMPs for orphan diseases) in 2025. This will be followed by remaining orphan drugs in 2028, and all centrally authorized medicines in 2030. This phased approach aims to ensure a smooth transition and allow for necessary adjustments during this multi-year process.

The EU HTAR is scheduled to go into effect on January 12, 2025. However, there have been significant delays of 3-6 months in developing the necessary guidelines and implementing acts. These delays are impacting the readiness of pharmaceutical companies and Member States as they take the first steps to align their national HTA and P&MA processes with the new framework. For example, the implementing act on JCA was expected by the end of 2023 but was ultimately signed in May 2024. This uncertainty regarding procedures and methodologies has created ambiguity, hindering the readiness of national healthcare systems or payer bodies.

Anticipated timeline for the JCA rollout

(Source: Regulation on Health Technology Assessment - European Commission (europa.eu))

In this article, Simon-Kucher explores the perspectives of national payers on how prepared EU Member States are for the EU HTAR implementation. To complement publicly available information and statements from the European Commission, EMA, and EU Member States, our team at Simon-Kucher engaged in discussions with 12 key external payer experts from several EU Member States, including France, Germany, Italy, the Netherlands, Poland, Spain, and Sweden. These discussions aimed to quantify national payers’ readiness and identify challenges and opportunities, offering insights into how payer bodies perceive the EU HTA transformation and are preparing for this expected shift in the European healthcare landscape.

Payers highlight procedural ambiguities and resource shortages for the EU HTAR implementation

European payers have identified two main challenges under the new regulation:

- Procedural ambiguity at the European level

- A shortage of both human and financial resources at the national level.

Procedural ambiguity stems from uncertainties in processes and methodologies at the European level, significantly impacting the preparedness of national HTA and P&MA bodies. National payers have been hesitant to develop strategies for integrating JCAs into their procedures so far, while they were awaiting the JCA implementing act. National procedures will remain central to Member State assessments, but the addition of JCA reports may raise concerns about potentially reduced autonomy for individual countries in the clinical assessment process. Moreover, the limited scope of the JCA in its first five years adds complexity to managing products with and without a JCA, requiring different procedures by product category (e.g., by 2025, new cancer medicines will be subjected to JCA, while indication extensions or medicines in other therapeutic areas will not). Additional uncertainty may arise from a possible scenario in which Member States do not compile the PICO survey and therefore the JCA report does not reflect their treatment realities – leaving open questions, e.g., on how the new technology performs compared to the most common SoCs in these markets and how they are going to use the JCA report.

Human and financial resource constraints further compound the issue. The lack of clear guidance on key aspects of the EU HTAR, including the expected number of PICO proposals, timelines, and templates, makes it difficult for countries to assess the resources and expertise needed at the national level for the JCA process. While larger countries, such as France, Germany, Italy, or Spain may have more resources and could adapt more quickly (e.g., AIFA is envisioning to update the P&MA submission dossier template, also considering EU JCA reports), this is not the case for smaller countries, such as the Netherlands and Poland. These smaller countries will have to analyze an additional document, beyond their standard assessment, and there will likely be a lack of initial guidance on how to integrate it into their local processes. Moreover, these smaller countries highlight further capacity constraints as staff accustomed to working in their native language adjust to handling an increased amount of data that needs translation before local analysis and application. This may require reallocating resources from other critical tasks or hiring additional resources to cover all necessary assignments. This issue was recently highlighted during the 9th meeting of the HTACG, where several Member States recommended that less experienced countries participate as observers in the initial assessments, to allow them to build further capacity.

Procedural ambiguities and resource constraints are obstacles that could prevent a smooth transition to the new regulation and may ultimately lead to further delays in market access for new therapies.

While the transition to the new regulation may pose initial challenges, payers acknowledge that the EU HTAR holds significant potential to create a more efficient, transparent, and collaborative environment for HTA in the EU. By streamlining and standardizing the clinical assessment of health technologies across Member States, the EU HTAR aims to reduce duplication of efforts and promote consistency in evaluations, yielding long-term benefits. The comprehensive data package available to all Member States may enhance national HTA assessments, and the harmonized approach may foster a more predictable and transparent HTA landscape across Europe. Additionally, payers are expected to benefit from increased collaboration and knowledge sharing among EU Member States, which can lead to continuous improvements in assessment methodologies.

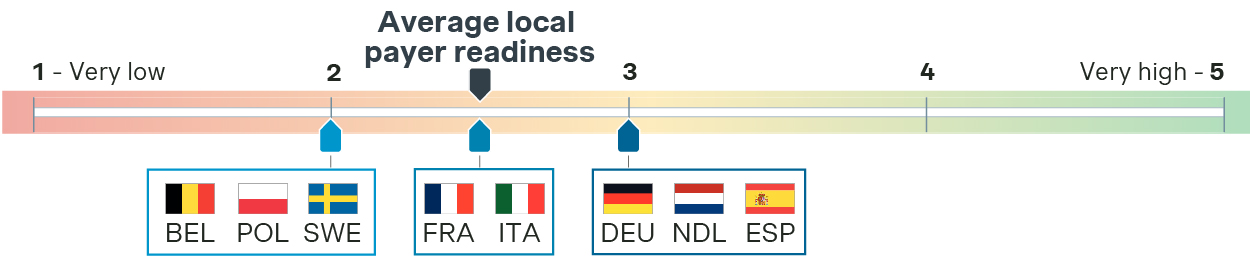

Current level of payer readiness is at best at low-to-moderate, but expected to rise by year’s end

In our interviews with key external payer experts, we asked them to evaluate the perceived level of readiness for the EU HTAR across EU countries, rating it on a scale from 1 (very low level of preparedness) to 5 (very high level of preparedness). We found that this score varied across EU countries, with an average rating between 2 and 3 out of 5 in the first half of 2024. No country has rated its readiness as “high” or “very high”, indicating a general lack of preparedness with the implementation deadline less than six months away. All the stakeholders involved in this study confirmed a cautious attitude, which is well described by a French expert:

"At the moment, we are taking a 'contemplative' approach as we carefully consider the implications and requirements of the imminent changes, and a new dossier template for the French P&MA submission has not yet been published." - Expert, France

Payer readiness for JCA implementation in the first half of 2024

(Rating based on external payer experts’ feedback)

Even Germany, with a history of participation in early JCA discussions and high involvement in EUnetHTA activities, does not rate higher than a “moderate” level of readiness, despite its apparent preparedness due to familiarity with these processes. A German payer commented:

“Our early involvement in JCA and EUnetHTA activities has positioned us well to navigate the upcoming changes, although there is still much work to be done to fully integrate the new requirements.” - Payer, Germany

Despite the low-to-moderate perceived level of readiness, some national authorities are taking proactive steps to ensure preparedness for the JCA. For instance, the Italian Medicines Agency released its new Regulation for the Scientific-Economic Committee in May 2024, which references JCA-related activities:

"[The CSE] expresses an opinion, limited to the national healthcare context, regarding the parameters for the Joint Clinical Assessment and the evaluation of the Joint Clinical Assessment."

(Art. 8 -Regulation for the Scientific-Economic Committee)

However, many other countries have not made similar efforts, largely due to the procedural ambiguity.

Payers anticipate a significant improvement in the level of readiness as the January 2025 deadline approaches. This is expected to be more pronounced toward late 2024, as ongoing efforts to align with the regulation will start to pay off, and additional clarity will be provided at EU level via the implementing and delegating acts.

Countries will leverage the EU JCA report in national HTAs with varying degrees of reliance

EU payers generally see the JCA report, the output of the assessment, as a helpful tool to standardize data across Member States. However, the extent to which national P&MA procedures will depend on it is expected to vary among Member States. While the JCA's design is meant to include the necessary data for comprehensive evaluations, some countries may have even stricter processes. As a result, those accustomed to such in-depth HTA procedures (e.g., Germany, France) may request additional data beyond what is provided in the JCA report (especially further subgroup analyses, including further data vs. (a) specific comparator(s), for example).

Manufacturers must still submit national dossiers in each Member State, with the key difference being that the clinical section of the national dossier should reference the EU JCA report. EU Member States can still request supplementary clinical data for their national HTA assessments, and any data received is planned to be made available and transparent to all other EU countries via the EU HTA IT platform.

Most national P&MA processes are expected to start once EMA marketing authorization has been granted. Even if the EU JCA is delayed, payers expect to still initiate the national P&MA process and then incorporate the JCA report into the process once it has been published. As one German national payer stated:

“The AMNOG is the AMNOG. It has a specific timeline of its own, and this timeline must be followed.” - Payer, Germany

However, in smaller countries there may be uncertainties about whether payers will be willing to start evaluating national HTA dossiers before the JCA report is available, potentially even leading to delays in access.

In larger Member States with advanced HTA processes, such as Germany and France, full national HTAs are expected, using the JCA report primarily for clinical information and supplementing it with additional data and analyses. Countries with less formal HTA evaluations (e.g., Italy, Spain) will use the JCA report as a partial basis but may request further clinical analyses. Conversely, smaller countries may rely exclusively on the JCA report to assess the clinical value of a product.

Degree of reliance on the JCA report for the clinical section in national HTAs (illustrative)

(Rating based on Simon-Kucher experts’ assessment)

The EU JCA may thus not only harmonize data requirements but also facilitate earlier price negotiations in certain (likely smaller) EU countries. This could potentially lead to new International Reference Pricing (IRP) dynamics and strategic considerations for manufacturers’ launch timelines and sequences. There is a possibility that prices in certain markets may be negotiated and published earlier than concluded negotiations in Germany or France, for example, setting a first benchmark for IRP.

Navigating the PICO framework presents key challenges for payers, beyond opportunities

The PICO framework (acronym for Population, Intervention, Comparison, Outcome) is a set of defined research questions that shape the assessment scope of the JCA for a new medicine, to ensure the treatment realities of all Member States are reflected in the JCA.

While payers understand that the PICO framework can bring crucial information to the European level, particularly concerning clinical comparators and outcomes of interest for a new medicine, they also see it as the biggest challenge in the new regulatory environment:

- PICO survey: Payers expect Member States to complete the PICO survey, even though it is not mandatory. However, uncertainties remain about the consequences if no Member State fulfills this obligation, with resource constraints being one main reason for not fulfilling it. Smaller countries might feel unprepared and, therefore, more reluctant to complete the PICO survey to avoid portraying a negative image of their healthcare system to other European countries (e.g., in case of no availability of clinical comparators for the new medicine in the country). This bears the risk that the PICOs may not fully reflect their specific need and the treatment realities across all Member States, and that ultimately the JCA report may therefore have important limitations for some specific countries.

- Uncertainties in PICO framework implementation: Although recent regulatory updates have clarified some aspects of the PICO framework, uncertainties remain. A significant issue is how to consolidate all PICO preferences into the minimal number of PICOs that still cover the needs of all 27 EU Member States. Early EUnetHTA 21 simulations (conducted for Pluvicto (lutetium (177Lu) vipivotide tetraxetan, Novartis), Ebvallo (tabelecleucel, Atara Biotherapeutics/Pierre Fabre), and Pombiliti (cipaglucosidase alfa, Amicus Therapeutics)) suggest an average of about six PICOs, but industry simulations indicate the possibility of a much higher number.

- Coordination challenges among national-level stakeholders: Coordinating PICOs presents significant hurdles, especially in defining evaluation elements and achieving consensus among national-level stakeholders. Strict deadlines further complicate the process, reinforcing payers' initial skepticism about the regulation's smooth execution.

As payers navigate the complexities of the PICO framework, addressing these uncertainties will be crucial for effective implementation and fostering seamless collaboration among all stakeholders, ultimately ensuring the framework's success and usefulness across all Member States.

Navigating uncertainty is key for manufacturers in EU HTAR preparation

The prevailing uncertainty surrounding the EU HTAR, especially the JCA process, is impacting both Member States and manufacturers as they prepare for forthcoming changes. Manufacturers, in particular, are grappling with challenges in crafting effective strategies amidst the shifting regulatory landscape. Trade associations such as EFPIA also argue that excluding companies from the scoping phase of the assessment heightens the risk of producing JCAs that fall short of their intended purpose and result in a wastage of resources. The current timeline segments the JCA process, restricting companies' understanding of the assessment scope and their ability to engage with assessors until later stages. Key documents are still being developed, and final definitions rely on implementing acts and guidelines, necessitating that manufacturers stay constantly informed, keep their finger on the pulse, and adapt quickly as more information becomes available, especially with the regulation's implementation less than six months away.

Given these tight timelines, manufacturers must closely track developments at both European and national levels to avoid delays and ensure compliance. This necessitates a comprehensive re-evaluation, meticulous planning, and clear communication of internal processes to ensure seamless organizational alignment with JCA requirements.

For each product launch, it is essential to pinpoint key research questions using the PICO framework and devise a robust evidence generation strategy.

Furthermore, companies must efficiently craft the optimal JCA dossier for EU HTA submission to achieve compliance and expedite market access. The EU HTAR aims to standardize assessments, but national procedures will remain integral to Member States’ evaluations. This means that manufacturers will need to adapt to new templates for submissions at the national level, ensuring cross-functional alignment at different levels (i.e., global, regional, and national), which will require additional efforts.

Interested in learning more? Contact our experts today to discuss this in more detail.

Simon-Kucher is further complementing this first study with an ongoing second study of the EU HTAR from an industry perspective. In this second study, we are analyzing perceived challenges and opportunities, assessing the overall level of preparedness, and identifying best practices and potential solutions.

Thanks to contributions from Christian Schuler, Dirk Kars, Robert Dumitrescu, Stephan Schurz, and Dmitry Goldenberg.

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.