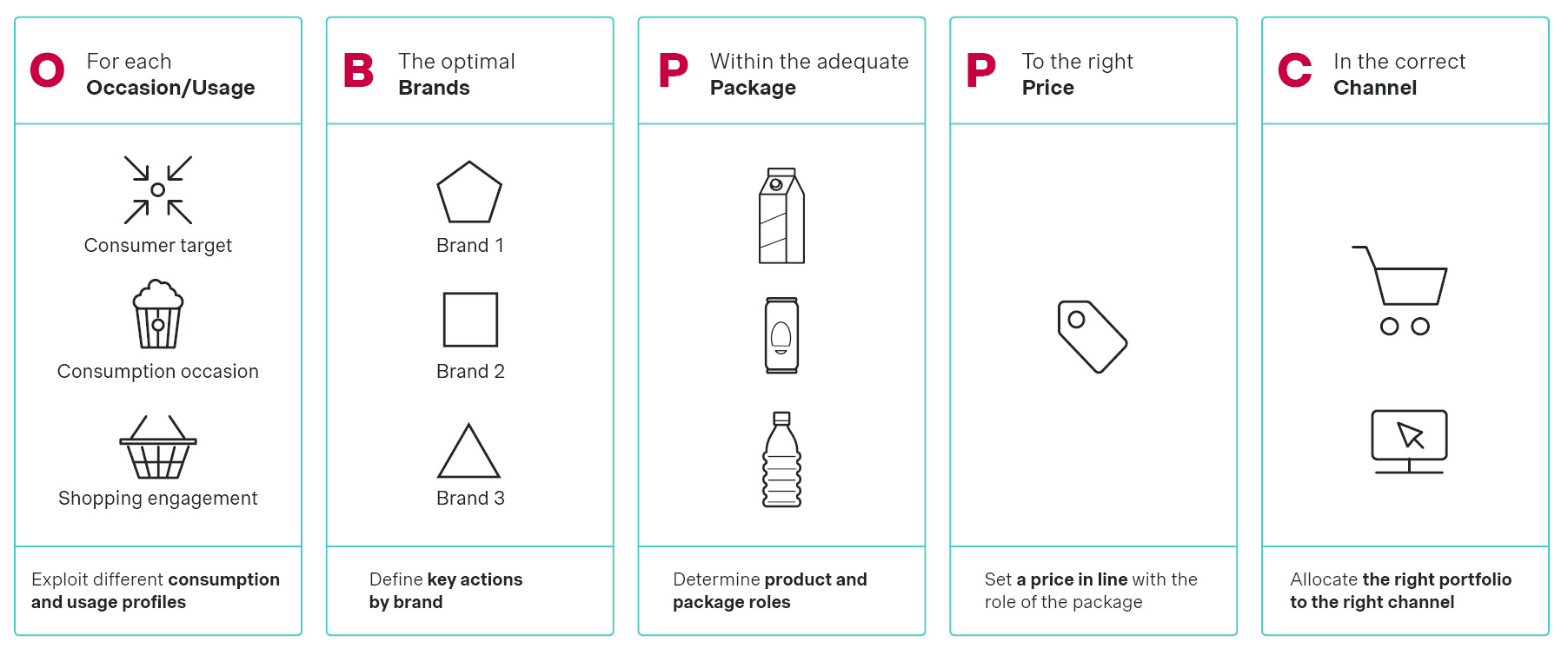

Within any Revenue Growth Management (RGM) framework, Portfolio Price Architecture (PPA) is a foundational strategy that helps consumer brands structure their pricing, products, and packs. PPA ensures that each product in your portfolio has a defined role and price point, serving different needs and shopper segments.

However, as consumer behaviors evolve and channel dynamics become more complex, traditional PPA is no longer enough to fully capture market potential. That’s where OBPPC (Optimized Brand, Price, Pack, and Channel) comes in.

OBPPC takes PPA to the next level by integrating deeper consumer insights, consumption occasions, and shopper missions into your pricing and product strategies. It provides a more holistic approach by connecting product formats, price points, and channel strategies, ensuring you not only meet demand but also drive category growth in a more sustainable way.

Many CPG companies manage multiple brands within their portfolio, each serving a different need or consumption occasion. OBPPC ensures you are serving more consumers, more often, with the right pack size and price point. This blend of consumer needs, product architecture, and channel differentiation drives both frequency of purchase and basket size.

By linking PPA with the broader RGM framework, OBPPC enables brands to unlock higher value, improve profitability, and stay competitive across all channels. In this article, we explore how an OBPPC strategy can optimize your portfolio and deliver lasting growth.

The consumer-first approach

Traditional PPA focuses on the product alone, but a successful OBPPC strategy requires putting the consumer and shopper first. Too often, manufacturers launch products without considering how they fit into the broader brand and product hierarchy. This fragmented approach leads to overlapping products that confuse consumers and dilute your brand’s overall value proposition.

In contrast, OBPPC is not just about launching new products; it’s about doing so profitably. It involves considering the entire portfolio – from brand positioning down to specific pack sizes – through the consumer and shopper lens. This enables you to optimize how each product fits across different channels and shopping missions.

The consumer is the end user —the one who will actually consume your product. The shopper is the person making the purchase decision in-store or online. As the consumer and shopper can be two different people, an OBPPC strategy helps you meet the needs of both.

You want your new products to grow the category, not compete with your own offerings or push consumers to lower-margin items. OBPPC helps avoid pitfalls like cannibalization or trading down within your portfolio. It also ensures you’re not oversaturating the market with too many products that fulfill the same need—streamlining your assortment while maximizing its relevance.

What does OBPPC with Simon-Kucher look like?

When we help brands develop an OBPPC strategy, we begin by deeply understanding your business, your shoppers, your consumers, and your market. Our approach is tailored, structured, and grounded in consumer insights, market data, and profitability. Here’s what working with us looks like:

1. Understanding shopper missions and channel dynamics

We start by analyzing the different shopper missions across each of your sales channels. Is the mission about bulk shopping for the week, a quick top-up, or an on-the-go purchase? Each mission demands a different product-pack-price strategy. For example, a stock-up mission in a hypermarket might call for larger pack sizes, while a top-up mission in a convenience store would require smaller, single-serve packs. We map these shopper missions to your channel strategy to ensure your offerings align with consumer behavior.

2. Defining product roles

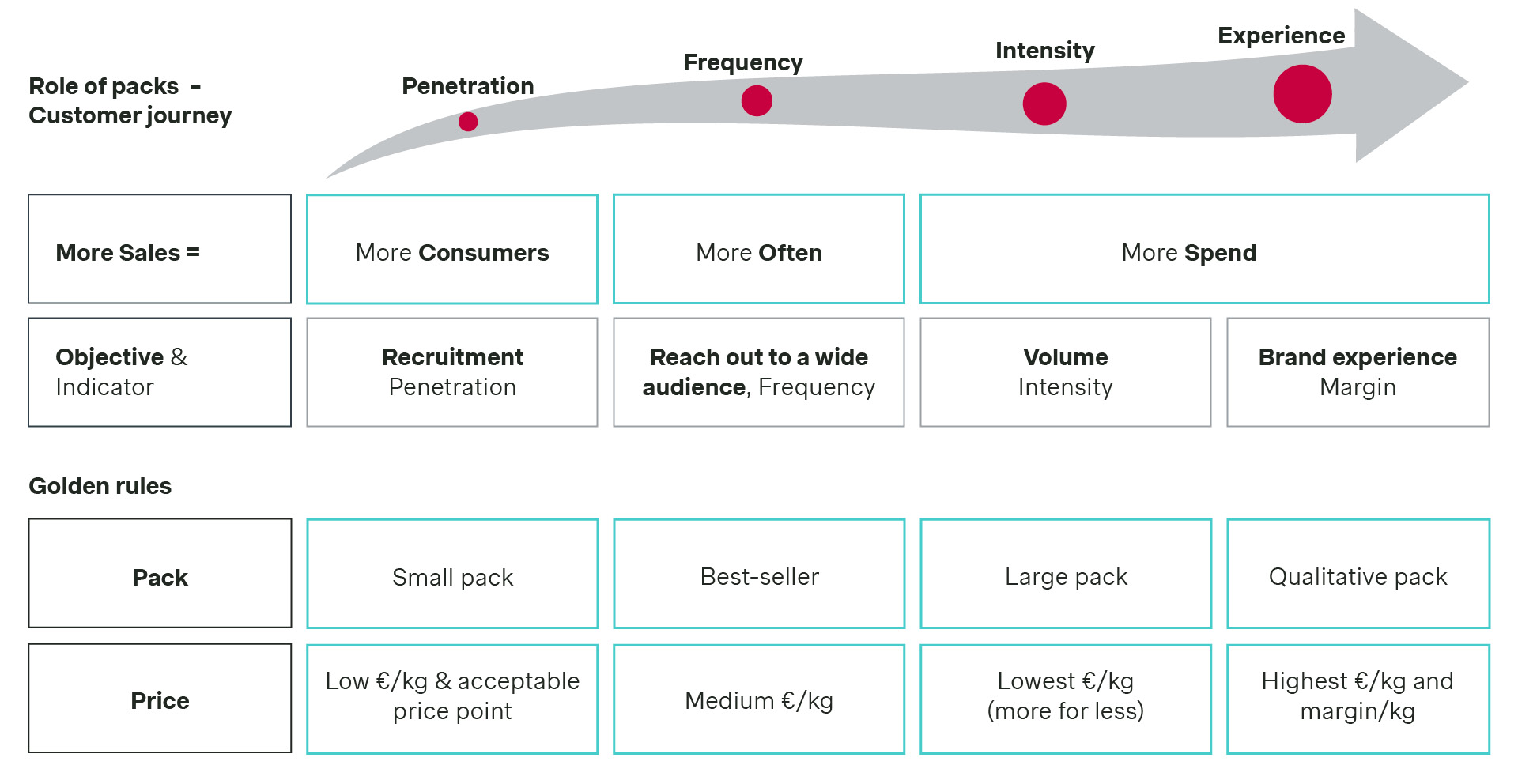

Once we understand the shopper missions, we help you define the role of each product in your assortment. Different products serve different purposes, and it's crucial to get this right for growth:

Penetration products: These are your entry-level products, often priced at a compelling price point to recruit new consumers. The goal here is to increase penetration, bringing new customers into the category.

Frequency products: These products target repeat purchases, often in slightly larger sizes, encouraging your existing consumers to buy more frequently.

Upsize products: Here, we focus on increasing the average transaction value by offering larger pack sizes or premium formats, encouraging consumers to spend more.

Experience products: These offerings deliver a premium or differentiated experience, often at a higher price point. The goal is to attract consumers less sensitive to price per unit and more focused on quality or uniqueness. Characteristics include special packaging formats, higher-quality ingredients, or limited editions that command a price premium.

![]()

3. Tailoring packs and pricing to consumption occasions

A key pillar of OBPPC is matching your product offering to the right consumption occasion. Whether your product is consumed individually, in groups, with meals, or on-the-go, the pack size and price should fit the moment. For example, a soft drink for an individual at lunch may come in a smaller pack size compared to a larger, family-oriented option consumed at a gathering.

How the product is presented—whether it’s a sleek aluminum bottle, an eco-friendly package, or a bulk pack—also plays a critical role in shaping consumer perceptions and driving purchase decisions. We analyze consumption occasions across channels and regions to ensure your pack formats are optimized for each scenario.

4. Market and competitive analysis

To stay ahead, it’s critical to know your market and competitors. We conduct a thorough analysis of your market landscape. For example, if you’re competing in the soft drink category, we look at the entire range of cans, bottles, and multi-packs offered in your market. We assess the price points, pack sizes, and formats used by your competitors and compare them to your own.

By understanding where the volume growth is happening and identifying gaps (white spots) in your current offering, we help you make data-driven decisions about where to focus your efforts. If we find a category where you’re missing out on growth, we guide you on developing the right products to fill that gap.

5. Aligning product and pack strategy with consumer segments

We also help you define the consumption occasions and consumer segments that matter most to your brand. For example, are you targeting kids who need small-sized beverages for breakfast, or families who need a larger pack for dinner? We map your product offering to each segment and occasion, ensuring you’re covering all important use cases with the right pack size and format.

6. Consumer testing and validation

Once we’ve defined the optimal product and pack architecture, we put it to the test. Through consumer surveys and shelf simulations, we gather direct feedback on your products. For example, we create a virtual supermarket shelf with your and competitor products, asking consumers which one they would choose. This helps us understand preferences around pack size, price, and format, as well as how consumers react to new products or packaging.

7. Optimizing price architecture and margins

When setting your final prices, we ensure your price per unit makes sense across pack sizes. We shape the price architecture so that consumers feel they’re getting a better deal as they trade up to larger sizes, which is crucial for encouraging up-trading and maximizing profitability. Additionally, we’ll guide you on how to leverage premium products for higher margins without alienating your core consumers.

8. Building a three-year growth plan

OBPPC is not a short-term fix—it’s a strategic approach designed to deliver sustainable growth over the long term. Once we’ve analyzed the market, defined your product roles, and validated your assortment, we work with you to build a growth plan that spans one to three years. This plan factors in supply chain considerations, ensuring you have the production capacity to meet demand, and aligns your promotional strategy across channels and retailers. We also recommend which products to phase out, where to launch new offerings, and how to manage the transition smoothly without disrupting sales or distribution.

This is all a mix of exactly what we at Simon-Kucher love: consumer view, market data, and profitability.

Ready to advance your price pack architecture to OBPPC? Let’s work together to unlock the full potential of your portfolio. Whether you’re in the beverage, food, or cosmetics industry, the principles remain the same: we optimize your portfolio to match the right product, pack, price, and channel for every consumption occasion. Reach out to our experts today.