Central and Eastern European (CEE) telco operators are innovating with some markets leading with hybrid portfolios while others favoring data-only bundles. There’s a shift from traditional voice and SMS to a future wherein smart pricing drives digital connectivity. With the 2024 Simon-Kucher Global Telco Study showing unlimited tariffs outpacing limited plans, discover how innovative speed differentiation and unique value-added services are redefining digital connectivity.

Telco services have rapidly adapted to meet the changing needs of consumers and keep pace with technological advancements. Traditionally, telco operators differentiated offerings based on voice and SMS services. However, the plummeting cost of internet access has led to a surge in data consumption, making data volume a key differentiator. There is an emergence of the “unlimited world” of voice and data which has unlocked a hassle-free customer experience of using telco services for a fixed price.

In 2024, Simon-Kucher Global Telco Study revealed that, for the first time, unlimited data tariffs surpassed limited data plans in terms of subscriber base. Despite unlimited world providing value opportunities for telcos, more mature markets like the UK and Netherlands have already reached a saturation point with unlimited data bundles, necessitating a search for alternative differentiation strategies. Mobile network operators (MNOs) are now exploring different paths: playing with Fixed Mobile Convergence (FMC) benefits, transforming telcos into commodity, leveraging speed differentiation, and integrating value-added services. In this article, we will focus on the last two paths.

Central and Eastern Europe (CEE) providers are no different, following a similar development path with unlimited data being “a must” in a portfolio. Among nine assessed markets (Bulgaria, Croatia, Czech Republic, Hungary, Poland, Romania, Serbia, Slovakia, and Slovenia), 87 percent of MNOs have unlimited tariffs in their portfolios. In each country, there is at least one unlimited data tariff to be chosen. However, similarities across all countries end here. CEE telco market develops at an uneven pace, with some countries (for instance, Bulgaria) being far ahead with advanced portfolios on a global scale when compared to those with simple, data-centric bundles. Depending on market maturity (ARPU levels, speed of development, and VAS integration) different development paths and customer-centric approaches should be explored.

Need for speed

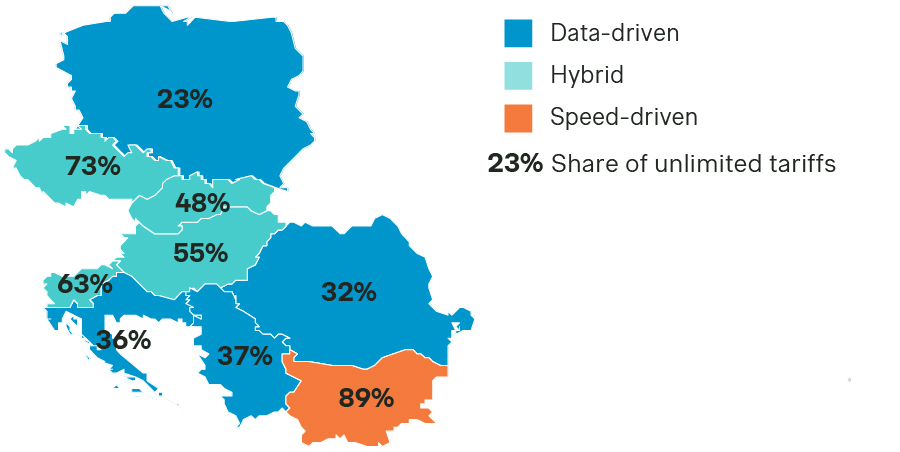

One key area of differentiation is speed. If we look at portfolio development stages, CEE telco markets can be divided into 3 clusters:

- Countries with data-only portfolios (Croatia, Poland, Romania, Serbia)

- Countries having portfolios with predominant unlimited data, but differentiated with speed (Bulgaria)

- Countries with both limited data bundles and speed differentiation in unlimited tariffs (Czechia, Slovakia, Hungary, Slovenia)

Dominant type of portfolio among providers

Source: Information collected from MNOs websites (post-paid from 8 countries and pre-paid from Croatia), September 2024

The figure above shows that at first glance, Bulgaria is the most advanced in terms of building an innovative portfolio in the CEE market, with large countries like Poland and Romania lagging with predominant data-centric value propositions. There is also a clear correlation between the share of unlimited tariffs and the stage of portfolio development. Clearly, the more unlimited tariffs are in portfolios, the more successful is a market for tiering unlimited data bundles and providing tangible differences between variants.

The distribution of speed levels within CEE telco portfolios also varies significantly. Some countries offer a few speed tiers, typically ranging from very low speeds (e.g., 1 Mbps) to maximum speeds, like Slovakia or Slovenia. Most likely, this combination appears in bundles offering unlimited data for max speed, but for a limited amount of data (after the limit is exceeded, speed is capped at a low speed.) In contrast, others provide multiple speed levels within their unlimited or hybrid plans, offering customers a wider range of options to choose from, with usable internet speed (approx. 10-100 Mbps) as the lowest/middle speed (like in Bulgaria, Czech Republic, or Hungary).

More bang for your buck

A second key differentiator is the inclusion of value-added services (VAS), such as video, music, gaming, or security services. These services can be integrated directly into tariffs or offered as add-ons. Our research shows that all CEE providers already have VAS in the offer. Nevertheless, the table below demonstrates that among CEE countries, there are different approaches towards implementing VAS.

VAS Included in | Limited data bundles | Unlimited data bundles |

| Bulgaria | 0% | 100% |

| Poland | 33% | 100% |

| Serbia | 67% | 80% |

| Hungary | 0% | 73% |

| Slovenia | 20% | 63% |

| Romania | 0% | 60% |

| Slovakia | 38% | 56% |

| Croatia | 0% | 50% |

| Czech Republic | 0% | 33% |

Source: Information collected from MNOs websites, September 2024

There is an overall tendency towards implementing VAS in unlimited data bundles rather than limited. This highlights the true use case for VAS in portfolios—to add value and differentiate unlimited bundles. Providers in countries like Bulgaria, Poland, Serbia, and Hungary have developed strong VAS preposition. Gaining a real market advantage can be obtained only with a unique VAS preposition.

Some CEE telcos are already trying to stand out with VAS offering. This is where the concept of swappable benefits will work—services that are charged with a fixed price per month (included in tariff or as an add-on) and which can be swapped on a monthly basis (e.g. Netflix in Month 1 of the contract, Disney+ in Month 2, etc.). Unsurprisingly, providers that have already included swappable benefits in their preposition represent countries with relatively higher VAS saturation among unlimited tariffs.

Mixed bag of prices

Understanding how CEE telcos value their tariffs is also a crucial point in assessing how mature the market is and how it can develop in the short- and mid-term. The first two points highlighted leading and lagging countries in portfolio progress; therefore, pricing analysis must prioritize risk assessment and preventative measures for providers.

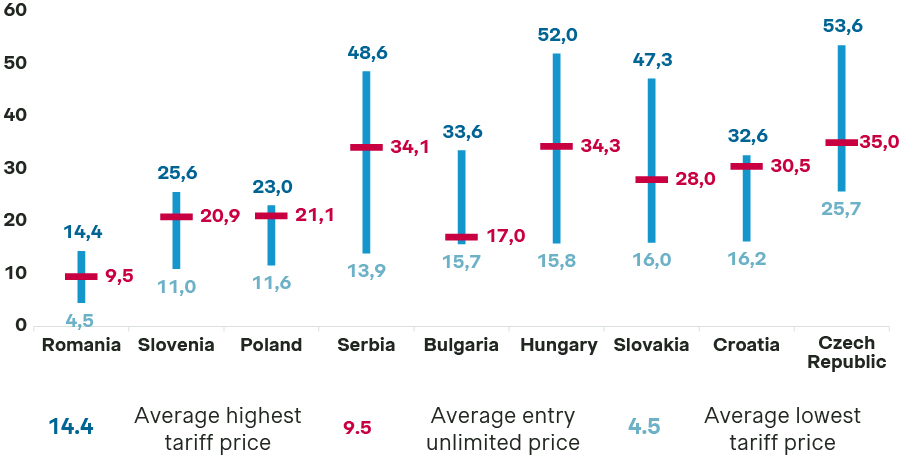

Average tariff prices (in EUR) per provider in a country

Source: Information collected from MNOs websites, September 2024

After mapping tariffs from 31 providers in nine countries, we find significant discrepancies in average monthly charges across countries, with Romania being notably cheaper than many of its neighbors. Furthermore, the price architecture within each country varies widely, with some operators offering a more limited range of price levels (like Slovenia or Poland) while others capture a wider range of price points, therefore building up their portfolios in a more jagged way (Serbia, Hungary, or Slovakia).

We also observe that entry-level unlimited tariffs are often strategically placed in the middle of a telco portfolio, acting as a reference point for customers. This positioning divides the portfolio into two segments: cheaper tariffs that may not offer significant additional benefits beyond the convenience of unlimited data, and more expensive plans that typically include bundled services, value-added features, and discounts on devices.

While examining absolute tariff levels provides valuable country-by-country insights and highlights initial market differences, anchoring the analysis with the tariff-to-salary ratio offers a more comprehensive understanding of how price levels affect future market development.

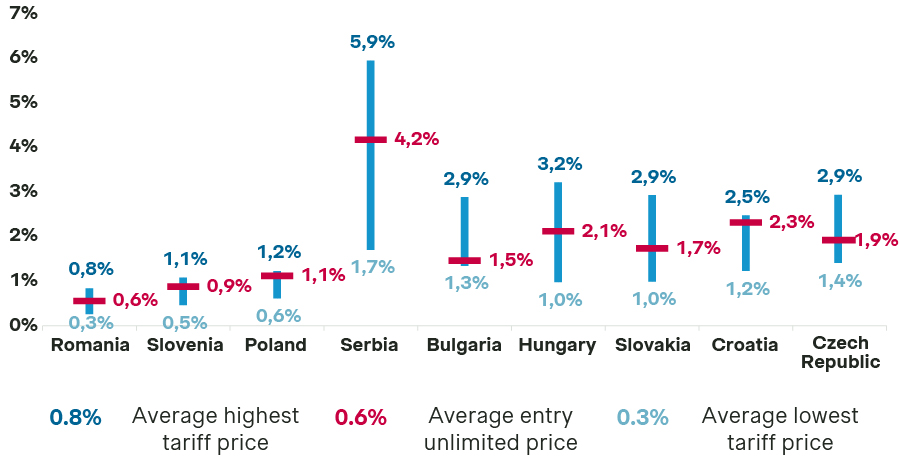

Tariff costs as % of average salary per country

Source: Trading Economics, information collected from MNOs websites, September 2024

When considering the average tariff price as a share of average salary, several countries in the CEE region, including Romania, Slovenia, and Poland, have a relatively low ratio. This suggests a higher risk of telco services becoming commoditized in these markets. To address this challenge, operators may need to implement smart price increases by leveraging additional VAS dimensions, such as gaming, cybersecurity, or FMC.

This is even more relevant for the Polish market, as competitors cover almost the same price points and there is an opportunity for smart price increases that also include value perception optimization. Serbia, on the other hand, has a large disproportion of limited and unlimited tariff levels. With the introduction of 5G, operators in Serbia have an opportunity to further differentiate their offerings through speed-based tiers, potentially driving higher adoption of unlimited plans. Hungary, Czech Republic, and Slovakia represent a hybrid portfolio model, with similar tariff-to-salary ratios. These countries can potentially gain a competitive advantage by focusing on VAS and offering innovative bundles that cater to specific customer segments. Croatia, with its relatively high unlimited tariff values and low unlimited tariff share, has an opportunity to fill the gap by introducing speed-differentiated unlimited plans. Finally, Bulgaria, which displays traits of a highly commoditized market, must explore more innovative strategies to maintain a competitive edge and discourage a switch to a fully unlimited world.

The key risk of going fully unlimited (without speed differentiation) with mobile portfolios is an inevitable loss of price differentiation ability leading to accelerated commoditization of mobile tariffs. For instance, we saw this happen in Italy in recent years, resulting in a significant ARPU decline. Therefore, Bulgarian telcos (and other countries, when markets reach a similar level of development) must rather focus on transforming into technology companies, offering new digital services, or investing in emerging technologies such as AI and IoT.

Following the Netherlands?

Without doubt, predicting the future of CEE telco markets is a hard nut to crack as there are multiple factors that can influence the direction of trends. Nevertheless, being a successful innovator is always more beneficial for a telco company compared to following or copying what other companies do.

Consider the Dutch market, which transformed with a successful portfolio and brand redesign by Odido (formerly T-Mobile). Entering the market with a new hybrid portfolio, including swappable benefits and an optimized value proposition, helped Odido establish itself as a market innovator and successfully capture a part of the market taken by KPN and Vodafone. The move was so significant that KPN decided to follow with a very similar hybrid portfolio a couple of months later.

CEE telcos also have this opportunity to build new competitive advantages. Nevertheless, understanding the specific dynamics of each market is essential to develop effective strategies to maintain and improve their competitive position. Our experts are here to support your journey to sustainable, profitable growth. Contact us today.