Hypergrowth remains the primary goal of most SaaS businesses. However, what defines growth? Even more importantly, what is a realistic growth rate to target? In recent years, the Rule of 40 has been a standard benchmark used to define a healthy SaaS company. This rule states that the sum of a company’s percent ARR (Annual Recurring Revenue) growth and its margins (free cash flow) should be greater than or equal to 40 percentage points. Several factors can contribute to each growth variable:

- ARR growth: There are multiple ways to achieve ARR growth – whether it be through organic growth (customer acquisition, customer retention, cross-selling, up-selling, etc.), new product development, or pricing.

- Margins: Factors here are not mutually exclusive of those contributing to ARR growth but can include other cost improvements across non-essential activities such as travel costs or essential activities like service quality and R&D investments.

However, most companies have historically struggled to achieve the Rule of 40. In fact, data from KeyBanc Capital Markets’ (KBCM) 2021 SaaS Survey indicated that only 29% of companies exceeding $5MM ARR managed to meet this target.

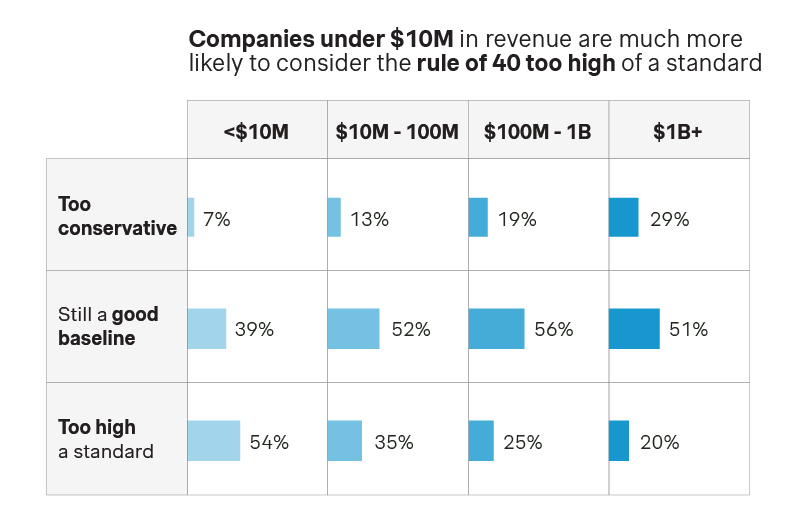

So, is the Rule of 40 still a relevant metric, especially given recent economic headwinds? According to 50% of SaaS executives participating in Simon-Kucher’s 2023 Global Software Study, the answer is no. However, this is not the whole story. The study also tells us that that not all growth metrics should be weighed equally, and that the Rule of 40 should be evaluated in each situation. For example, it appears that revenue size likely plays a role when evaluating this age-old rule.

While only around one-third of overall respondents believe the Rule of 40 is too high a standard in the current economic environment, over half of small SaaS companies (those with less than $10M in revenue) consider the target unattainable. On the other hand, larger firms (those with over $1B in revenue) are likely to view the Rule of 40 as too conservative.

Smaller or newer companies will likely have a more difficult time achieving the Rule of 40 due to several factors: needing to build teams and retain staff, time spent gaining new customers, and developing and setting up the ways they go to market. These factors are likely to require high investment costs in relation to their size and squeeze margins. Newer companies may not have the experience or resources to properly navigate the current economic climate.

In this context, indexing towards a 40% growth metric does not set them up for success: it is not only an unrealistic goal, but may distract them from other initiatives (such as hiring the right staff, focusing on customer acquisition and on sales strategies) that would allow them to scale later on. In contrast, larger companies who can achieve greater operational efficiency and have a stronger grasp on the market are more likely to sustain the Rule of 40.

What is a reasonable goal if the Rule of 40 is not realistic for your company?

Based on responses during our study, executives at small firms report that in the current economic climate, a 10-30% growth and profit margin target is a much more sustainable goal.

Starting smaller and encouraging a right-sized approach to growth until a company can achieve critical mass in revenue is likely to be more sustainable in the long run. This allows growing companies to focus on initiatives that are critical to their future growth and profitability, until they can strike a balance between the two.

All in all, the Rule of 40 is not dead, but it should not be your only plan of action. If we want to fairly assess SaaS companies, then their economic environment, their company size, and their growth stage should be taken into consideration before any conclusions are made.

In this article we discussed the relevance of the Rule of 40, but your business likely has even more areas where it can improve. Reach out to our growth experts at Simon-Kucher if you are ready to accelerate your return to growth.

The Global Software Study survey was conducted from May to July 2023 by Simon-Kucher, with fielding through panel data provided by RepData, an independent market research agency. The study surveyed 500+ software executives across 20 countries, including the United States.