Discover how applying the right packaging and pricing strategies can create a winning offer.

Key takeaways

- Australians and New Zealanders are reconsidering their energy provider, prompted by the current economic conditions and rising switching rates in the past year.

- Energy plans in Australia and New Zealand are not optimized, presenting an opportunity to improve packaging and pricing for more effective acquisition, monetization, and retention.

- To achieve this, energy providers need to 1) develop a needs-based customer segmentation; 2) create a clear value-based packaging line-up, and 3) ensure sufficient price differentiation to tap into willingness to pay.

Australians and New Zealanders are actively switching between energy providers in response to the ongoing cost-of-living crisis. Switching rates have increased over the past year, emphasizing the heightened competitiveness within the market. In July and August of last year alone, a record-breaking 450,000 homes changed providers.

As lock-in contracts and exit fees are uncommon, energy companies need to define distinct strategies to a) attract new customers, b) increase existing customer value, and c) prevent customer churn.

A refined approach to proposition development (‘packaging and pricing’) is instrumental in achieving these objectives. Across multiple utility and service industries, such as energy, telco, and insurance, we see that improvements to packaging and pricing strategies increase net income by double digits.

In this article, we uncover the current state of the Australian market and explore how energy providers can develop effective propositions that stimulate acquisition, monetization, and retention. We will examine the importance of segmentation, detail how you can develop attractive packages for these segments, and discuss the role of pricing in this equation.

Segmentation

How are energy providers addressing different consumers?

Australian and New Zealand energy providers are responding to consumer switching behavior by designing distinct packages with ancillary products and rates to better serve and retain different segments.

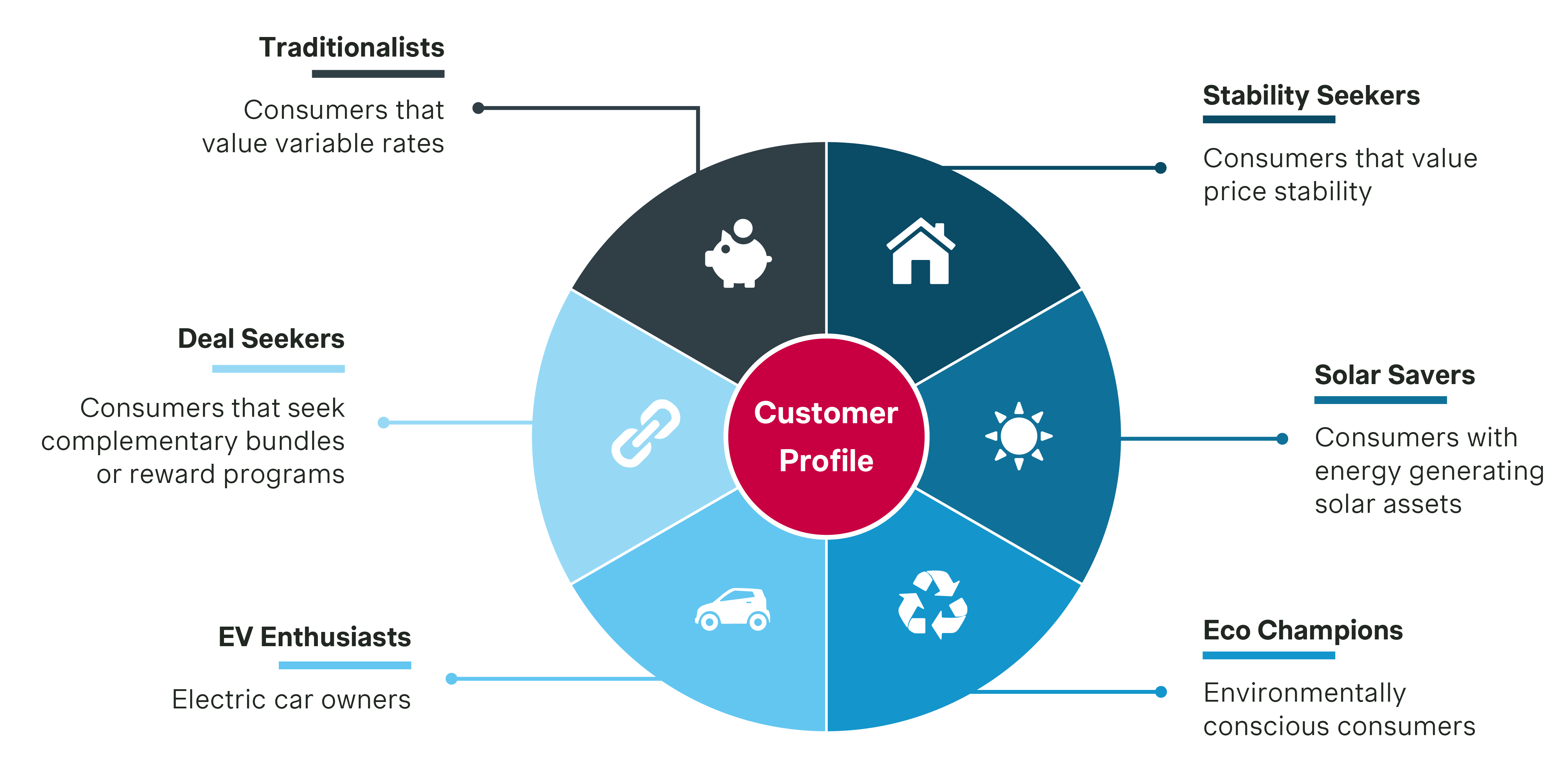

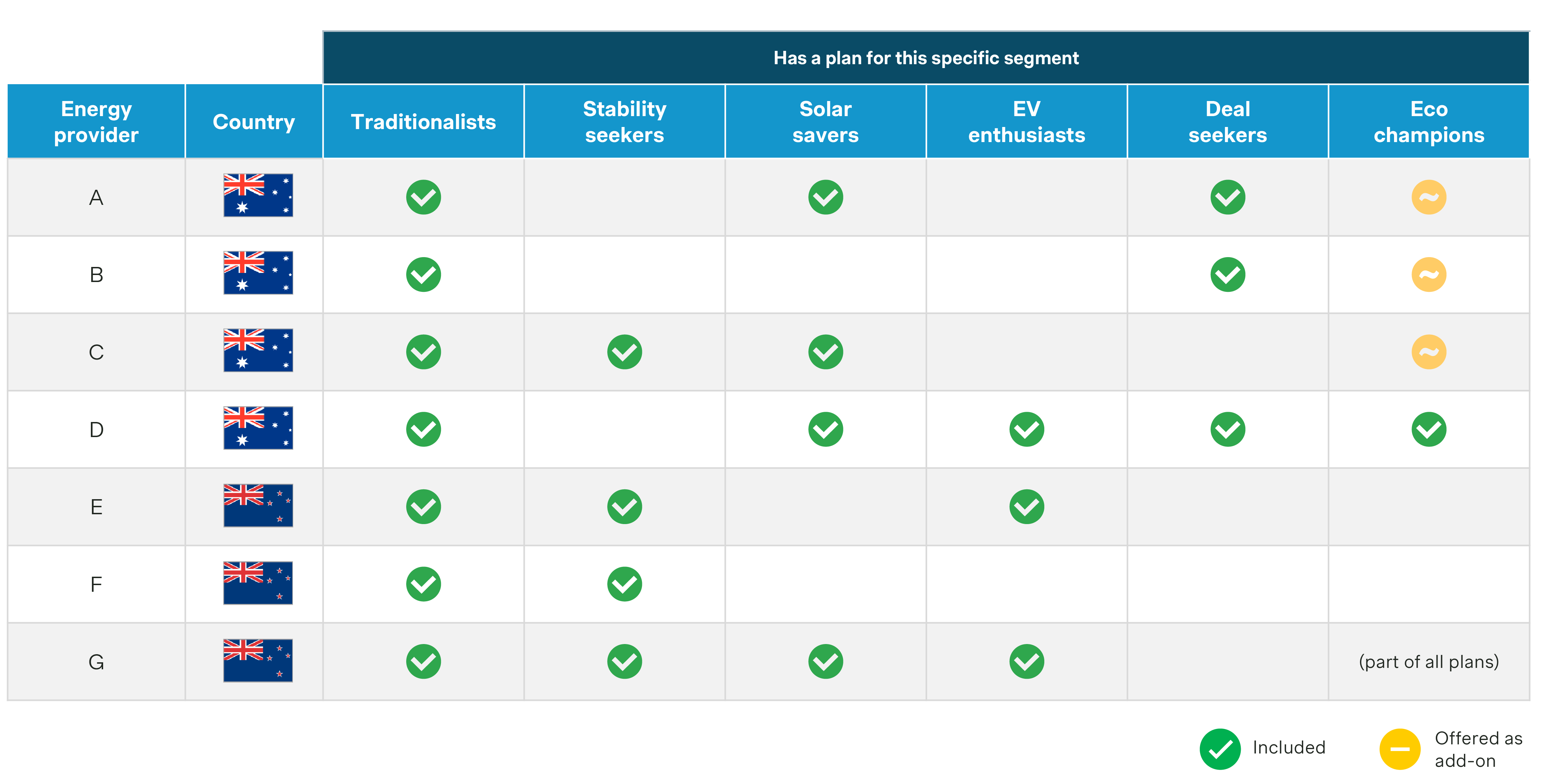

Our assessment of the top seven Australian and New Zealand energy providers reveals multiple propositions for six specific customer segments:

- Traditionalists: Consumers who do not mind price variability, on variable rate contracts

- Stability seekers: Consumers who value stability, on fixed rate contracts

- Solar savers: Consumers with energy generating solar assets, on ‘solar feed-in’ plans

- EV enthusiasts: Electric car owners, on EV electricity plans

- Eco champions: Environmentally conscious consumers, on carbon offset plans

- Deal seekers: Consumers who seek complementary bundle or reward programs

Most Australian and New Zealand providers offer two to five distinct energy plans to attract different customer segments. Among the seven energy providers analyzed, five offer plans tailored for solar savers and/ or EV enthusiasts, four provide options for stable rates, three cater to deal seekers through a bundled offer or reward program, and one offers a dedicated plan for eco champions.

So, how can we make segmentation work? A good segmentation strategy needs clear trade-offs: providing multiple segments with distinct value propositions while reducing the risk of confusing the consumer or creating choice overload.

Way forward: Segmentation for commercial success

In this context, segmentation serves two means: First, it allows energy providers to identify untapped segments. Second, it allows them to understand how to better serve the existing customer base to increase retention and extract more value.

Segmenting a customer base in a meaningful way is challenging as it needs to go beyond simple demographics. For example, two separate three-person households living in a Melbourne suburb on average incomes might have vastly different perceptions of what they seek in an energy provider.

To make segmentation useful, there are three things to uncover:

- Value drivers: What do customers actually value? Effective segmentation involves assessing the relevance of underlying value drivers and determining the importance of each attribute. Customers are often categorized as cost-focused, flexibility-focused, or service-oriented, but these profiles tend to resonate broadly and lack distinctiveness. By evaluating the relative importance of four to seven value drivers, you can identify distinct, needs-based customer segments.

- Target versus base: Does your current customer base differ from your target segment? Significant differences in value drivers across segments can justify creating a distinct plan to attract new customers. Smaller differences necessitate more careful packaging design as new energy plans can trigger existing customers to switch. Therefore, it is crucial to understand how the needs of your current customers differ from those of your target customers.

- Consciousness: How conscious are consumers about selecting a provider?

Conscious customers will need less activation and are more outspoken regarding their needs, while unconscious customers require greater effort for activation but are less likely to churn.

Packaging

How can providers enhance package appeal?

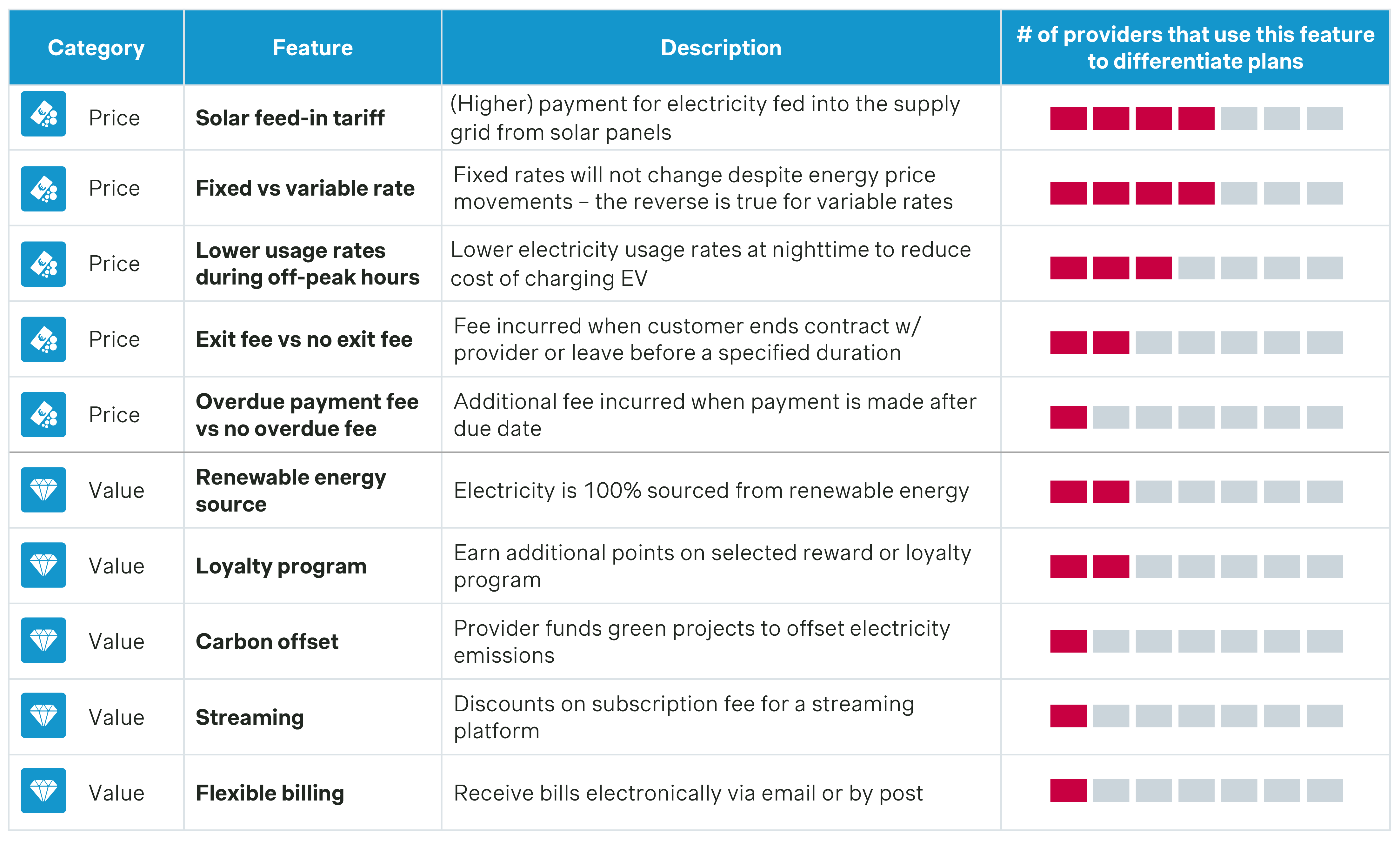

Energy retailers leverage both value-features and price-features, in addition to price differentiation, to enhance package appeal. Retailers use features as differentiators in their energy plans to distinguish and highlight packages. For instance, the most used differentiators are rate types, off-peak rates, and higher solar feed-in tariffs. Meanwhile, ‘no exit fees’ and ‘100 percent renewable energy’ serve as additional sources of value and differentiation. However, providers should avoid overloading packages with a multitude of features.

- Overloading confuses customers and obscures package value: When packages have too many features, it increases complexity and makes it difficult for customers to understand the core value proposition of the package. Prioritization criteria could be based on incremental customer value. For example, offering flexible billing that allows customers to receive bills via email instead of traditional mail might not significantly drive value, given the widespread use of email.

- Adding features could decrease package appeal: The addition of certain features could be counterproductive and reduce package attractiveness. For instance, including carbon offsets across all packages arguably diminishes the appeal of a dedicated green and carbon neutral energy plan as it leads customers to question the rationale behind opting for more expensive plans when comparable benefits are available across the board.

Way forward: Customer-centric energy plans for long-term growth

After building a solid segmentation strategy, it's time to construct packages. Consider these four key points:

- Keep it concise. The packages you construct need to resonate with your customer segments, but they do not need to align directly to the various segments identified since developing various unique packages could lead to an overwhelming array of choices, resulting in unclear value propositions and choice overload that confuses customers. To avoid this, it’s best to limit number of packages to three to five distinct plans.

- Understand what drives incremental value. To develop effective packages, you need to understand what drives incremental value. For example, a highly cost-conscious customer might prefer a simple energy plan. However, they may be willing to spend more if they get a great deal. Think of reward programs, discounted streaming subscriptions, bundle discounts, or increased miles in a frequent flyer program. This is also where you can get creative by testing features through in-depth customer research.

- Consider leaders, fillers, and killers. Every plan needs a clear ‘leader’ feature that differentiates it from other plans. It's the one shiny product or service that's pulling a segment toward that plan. Complement this with a few ‘filler’ features that add incremental value to the plan and allow for price differentiation. Lastly, watch out for ‘killer’ features – those that make consumers wonder why they are paying for it, leading to package rejection. In the context of fast food, your ‘leader, filler, and killer’ features are burger, fries, and coffee respectively.

- Communicate value. Once all the bits and pieces are in place, tailor your communication to what drives value. Start with the items included in every plan that are important to every customer. For example, flexible contract terms and no exit fees are great features typically included in every plan and relevant to all customers. This is the promise of your brand. Then highlight your key differentiators per plan and how they add value. Ideally, you would add a personalized recommendation based on 2-3 energy usage questions.

Pricing

Are energy providers making the most of price differentiation?

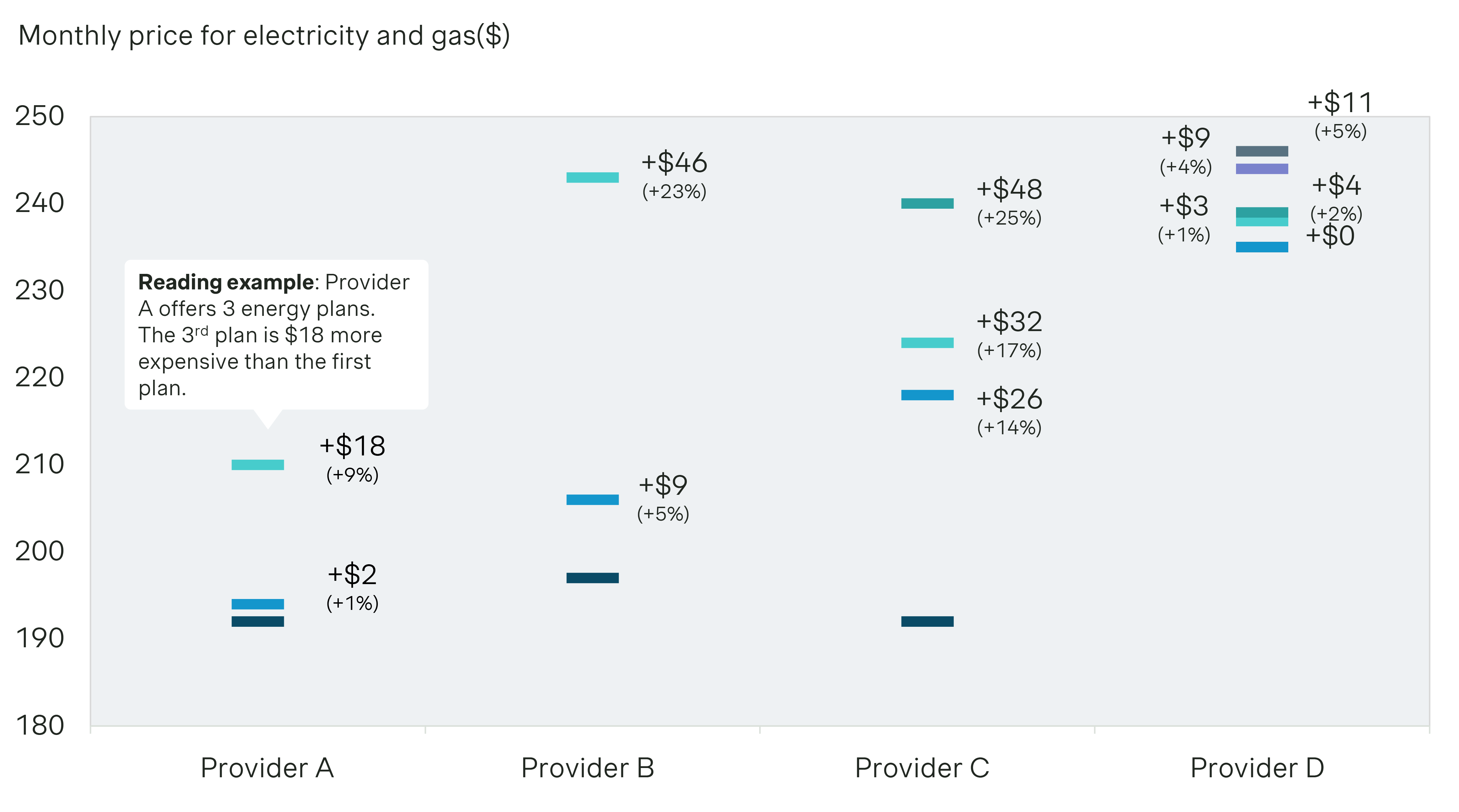

Price differentiation is important to accommodate customers with varying levels of willingness to pay. However, most Australian energy providers currently apply limited price differentiation. For one provider, the price difference between the lowest and middle-priced package is only $2 (+1 percent). Similarly, another provider exhibits minimal price variation to the extent that two packages even share the same price. On the other side of the spectrum, large price differences prevent customers from upgrading to premium plans. For example, the most premium plan for provider B comes with a 23 percent higher energy bill compared to the most economical plan.

Both limited and excessive price differentiation have several drawbacks. First, they create confusion around the value proposition. Second, they limit ability to acquire and more effectively monetize the customer base – conventionally, a strong pricing lineup enables providers to ‘land’ customers at lower-priced packages and ‘expand’ them by converting them to higher-priced, higher-value packages. Thirdly, extreme price gaps hinder retention. Large price differences lead to a strong drop in annual contract value (ACV) when customers downgrade, while small price gaps do not offer viable downgrading alternatives, thus increasing the risk of churn.

Note: Rates shown are based on April 2024 data for households with ~3,900kWh of electricity and ~18.25MJ-20.00MJ of gas usage/ year in postcode 2135. Each color represents a distinct package offered by the provider.

Way forward: Effective strategies for mastering price and value

- Calibrate value and price tiers. Pricing starts with ensuring a clear value distinction across your packages that justifies price differentiation. Each package should showcase distinctive ‘leader’ features that deliver substantial added value, resonating with customers' willingness to pay. If features are merely perceived as ‘nice-to-have,’ there will be limited opportunity to differentiate on price.

In case the value difference between plans is too low, let us say a few dollars, you risk missing out on monetizing a high-value plan. If it is too high, customers will not be incentivized to upgrade, meaning you will miss out on a higher ACV. Therefore, a well-calibrated balance across plans is key to success.

- Communicate savings. Some energy plans have additional price benefits which are harder to recognize for consumers. For example, a higher solar feed-in tariff can offset the price of a higher energy rate. Energy providers should strive to communicate the expected savings from such a package, guiding customers to the plan that would resonate most with their needs.

- Be as transparent as possible. Consumers do not appreciate surprises when it comes to pricing, especially on utility contracts. Allow people to make a fair price comparison across your plans but highlight the benefits, for example, the price difference versus the standing offer.

How we can help

Developing a sustainable packaging and pricing set-up requires in-depth customer research. This includes specific analyses to fully flesh out segmentation drivers, relevant features, and their values and price sensitivities. If done right, it will lead to better customer acquisition, increased ACV, and reduced churn.

At Simon-Kucher, we can help optimize your packaging and pricing strategy. Our consultants have the expertise to support our clients’ acquisition, retention, and monetization goals within the energy sector and beyond.

If you would like to know more about how to do this and build lasting capabilities in your team, feel free to reach out to us to further discuss.

This blog was written in collaboration with Megan Tanoyo (Consultant)