In Spain, balancing the right to access information from public administration with the necessary confidentiality of drug prices is a major challenge for the pharma industry and the National Health System . This article examines the consequences of increased price transparency on manufacturers and patients in Spain, considering the existing international reference pricing (IRP) connections.

Spanish civil associations have recently started requesting information from the Ministry of Health (MoH) about the funding conditions and hidden net ex-manufacturer prices of high cost innovative therapies from various companies (e.g., Crysvita (Kyowa Kirin), Veklury and Yescarta (Gilead), Mepsevii (Ultragenyx), Takhzyro (Takeda), Luxturna and Zolgensma (Novartis), Spinraza (Biogen), among others).

Both the MoH and the manufacturers refused to disclose this confidential information based on Article 14 of Law 19/2013, of December 9, of the Spanish Law on Transparency. This Article limits the right to access information generated by the public administration if it poses harm to economic and commercial interests, professional secrecy, intellectual and industrial property, or if confidentiality is required for public decision-making processes, among others.

However, the Spanish Transparency and Good Governance Council (“Consejo de Transparencia y Buen Gobierno”) rejected these arguments, stating the harm to the companies’ economic and commercial interests was not sufficiently (“in concrete, defined and evaluable terms”) proven. Instead, the Council approved the Spanish civil associations’ request to access information on the prices of innovative therapies, currently only for Yescarta, Luxturna, Zolgensma, with potential future implications for other products.

Both the MoH and the affected manufacturers appealed this decision, alleging infringement of several sections of Article 14 of Law 19/2013, taking the issue to court. But the court did not find any breach of the mentioned limits to the right to access information from the public administration. Consequently, the court concluded that making the specific funding conditions in Spain and the confidential net ex-manufacturer price public does not entail any economic or commercial harm for the manufacturer.

Official statements, including those from the Secretary of State for Health, Javier Padilla, indicate that the MoH may stop defending drug price confidentiality in court and comply with judicial rulings. They claim price transparency can be improved without undermining Spain's ability to negotiate drug prices.

While uncertainty remains regarding the MoH's position on future requests to access net pricing and financing conditions, manufacturers still believe disclosing net prices could cause substantial economic and commercial damage both in Spain and beyond.

But is this really true? To understand the potential risk, it is necessary to understand how international reference pricing (IRP) works.

International reference pricing in a nutshell

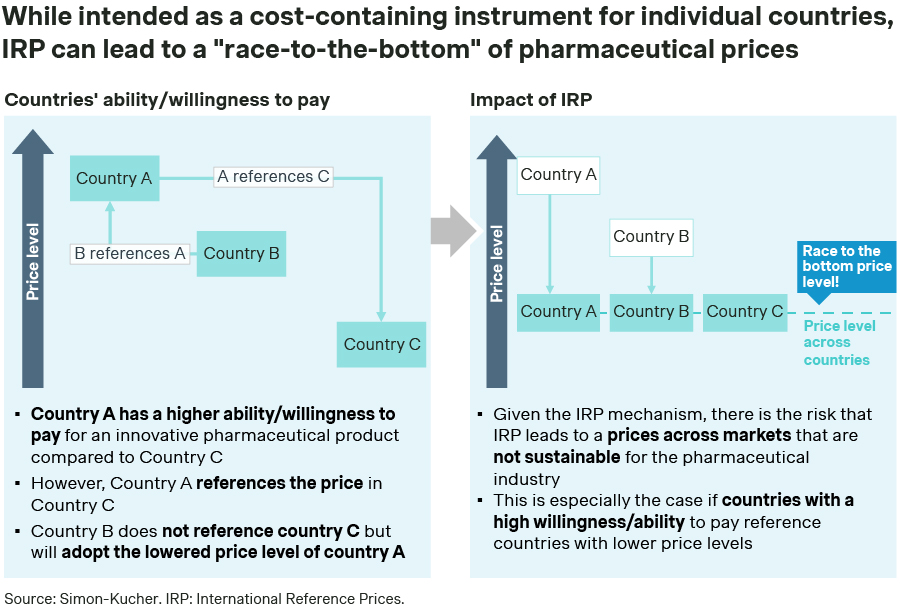

When setting the price of a new medication, authorities in many countries consider the price of the same drug in other markets. This mechanism is known as international reference pricing or IRP. The idea of IRP is to provide Price and Market Access (P&MA) authorities with price benchmarks for drugs in other countries to establish an adequate price level for new medications in their own country. However, it is often used as a cost containment tool to control prices of innovative pharmaceuticals.

Depending on the country, this price referencing may be informally used in negotiations (“Why should we pay a higher price for this medication than what other countries pay?”) or constitute a formal price threshold that the price within the country cannot exceed.

As a result, manufacturers should carefully consider the challenge of IRP when developing an international launch pricing strategy for an innovative drug. For example, if a relatively low price is revealed early, it could prevent achieving a price that adequately reflects the drug’s value in referencing countries or lead to an accelerated price erosion worldwide. The consequence of IRP can cause severe economic harm to pharmaceutical manufacturers.

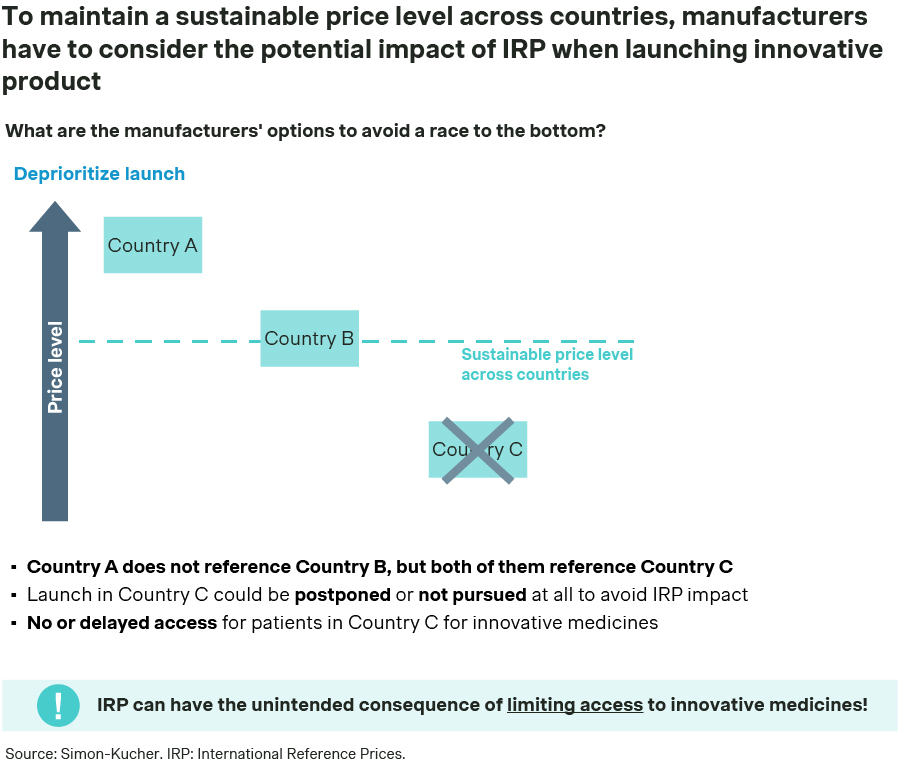

In some instances, IRP can lead to price spill-over from one country to another and the associated economic loss can make it unsustainable to sell a drug in certain markets or launch it in those countries (Figure 1).

Figure 1 – IRP consequences when different prices for different markets are allowed

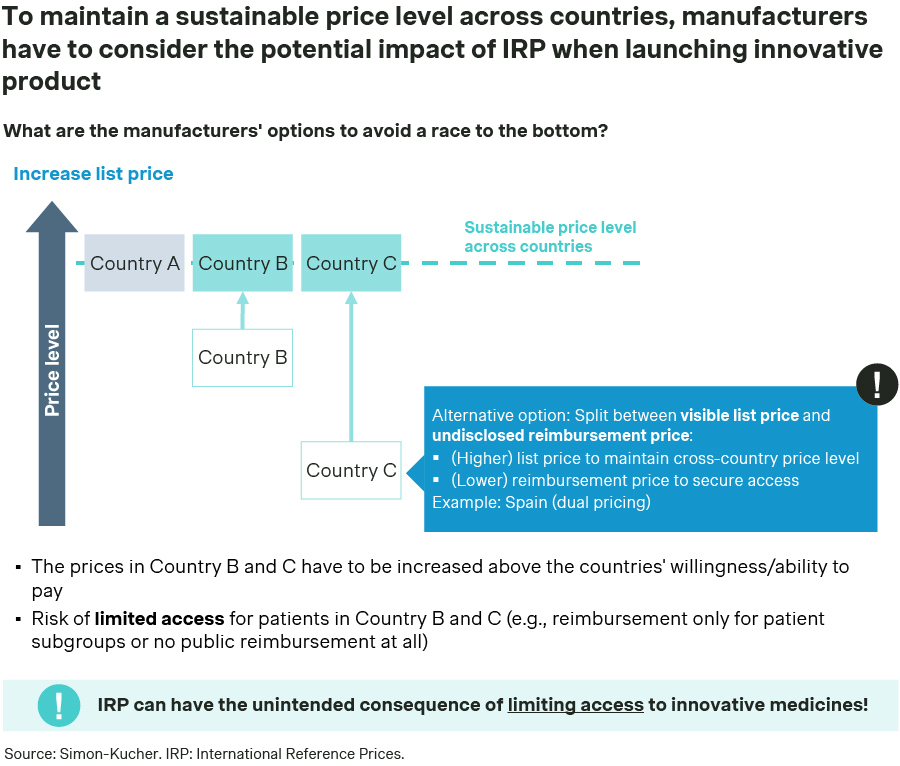

To prevent the risk of price erosion, manufacturers can adopt a flat-price strategy, i.e., introducing the product at a similar price in all relevant markets. However, this flat-price strategy has two challenges:

- The price set can be lower than the willingness to pay, failing to reflect the drug’s value.

- The price set can be higher than the willingness to pay, increasing the complexity of the negotiations and risking access restrictions or no reimbursement in some markets.

Manufacturers can minimize the risk of price erosion by targeting a flat-price strategy at a price aligned with countries willing to pay more (Figure 2), which prevents lower prices from being referenced. However, it may hinder access to pharmaceutical innovation in countries with lower purchasing power (due to access restrictions or failing to agree on the reimbursement conditions).

To address this issue, countries like Spain have implemented a dual pricing system. This system includes a public list ex-manufacturer price that can be referenced and a confidential net ex-manufacturer price paid by the National Health Service (NHS), ensuring access to the product at a price in line with the country’s willingness to pay while protecting manufacturers from IRP-related price erosion.

Figure 2 – Options to mitigate price erosion

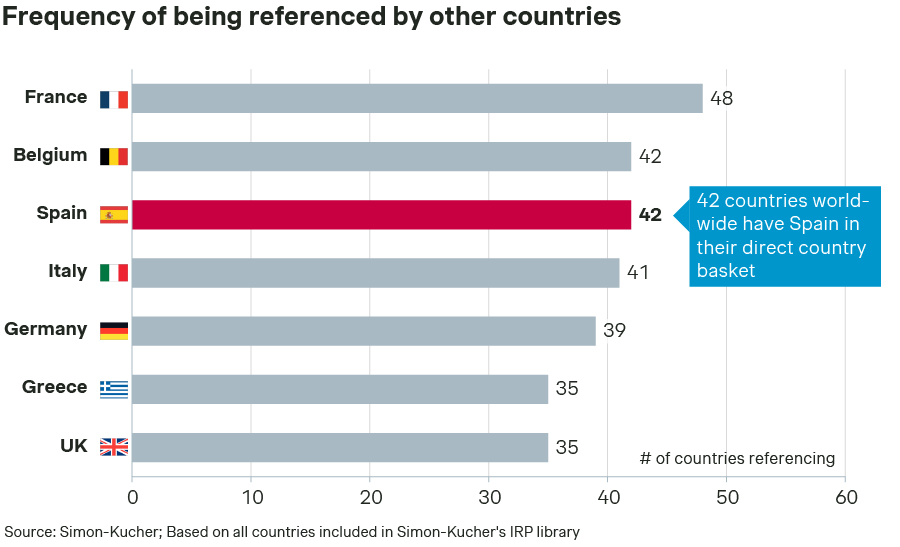

While IRP is not the primary criterion in setting drug prices in Spain, the country’s drug prices play a critical role as Spain is the third most often referenced country globally (Figure 3). This makes drug prices in Spain important for most European countries as well as world-wide across regions.

Figure 3 – Number of countries referencing drug prices of specific country via IRP

Therefore, if the net ex-manufacturer (in theory, confidential) price from Spain is made visible to each stakeholder who requests access, it could also be considered by P&MA authorities in other countries:

- Informally in price negotiations, as negotiators can argue with the actual, now visible, reimbursed net price in Spain.

- Formally, as net prices are now provided by official sources in Spain (and not only leaked).

This clearly poses a risk to higher price negotiation across countries, potentially causing economic and commercial harm to manufacturers.

In addition, if there is a risk that the national net ex-manufacturer (in theory confidential) prices and the funding conditions in Spain are made public, manufacturers may stop offering price concessions to meet payers’ willingness to pay, as the country’s drug prices will need to be aligned with the international price strategy. This could impact the sustainability of the Spanish NHS as drug prices will likely need to be higher compared to the current confidential, hidden net prices. The outcome could be a further increase of access restrictions, market access delays, or even prevent the launch of innovative drugs in Spain (Figure 4).

Figure 4 – IRP consequences

Conclusion: Risk of unintended impacts

The MoH’s obligation to disclose funding conditions and hidden net prices in Spain for certain innovative pharmaceuticals could have unintended impacts on both drug manufacturers and the NHS:

- Manufacturers face real economic and commercial harm if undisclosed net price of a treatment across countries does not reflect the product's value and spills over to other countries via IRP. If the commercial risk across countries outweighs the commercial opportunity in Spain, manufacturers have the option to not launch a drug in the country.

- The Spanish NHS runs the risk of having a reduced negotiation flexibility, leading to higher drug prices in the long run. If the trend of “making hidden net prices visible” in Spain continues, manufacturers may hesitate to offer net price concessions to the NHS for fear the real net prices in the current Spanish dual pricing system become public and are referenced by other countries. This could affect the NHS system's sustainability and, ultimately, the health outcomes of patients in Spain.

Therefore, manufacturers should closely monitor requests for information on pricing and access conditions by Spanish authorities, anticipating a potential need to publicly publish this information. They should also demonstrate in court the “concrete, well-defined, and evaluable” economic and commercial harm the publication of hidden net prices of drugs poses to pharmaceutical companies and the industry as a whole.

How can Simon-Kucher support pharmaceutical companies?

Simon-Kucher can support pharma companies across the whole lifecycle of the drug: from real-time decision-making to long-term planning. Our approach ensures that drug launches are not just successful in the present but achieve sustainable and long-lasting success.

The development of a robust IRP strategy and international launch sequence optimization is an integral part when developing launch strategies for innovative pharmaceuticals. At Simon-Kucher, we utilize a comprehensive IRP solution that was developed with a strategic perspective in mind. Our IRP rule library covers over 100 countries and considers the specific regulations of each country, regularly updated with the latest official legislations and insights from our local country-experts, that keep track on how those regulations are applied in practice. Incorporating an advanced Monte-Carlo algorithm, it reflects formal and informal IRP rules and uncertainties in any assumption to build a robust international pricing strategy. Our Simon-Kucher LS Genius | IRP can also be licensed to clients to help set the most effective price strategy and estimate the economic and commercial impact of publishing hidden net prices in Spain.

If you are looking to launch an innovative pharmaceutical product but are worried about international reference pricing implications, reach out to our experts to discuss your challenges!

To learn more about our expertise and capabilities, reach out to our authors!

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.