Gone are the days of stiff dress shoes and towering high heels — today's footwear game is all about fit and comfort. The seismic shift away from formal workwear, exacerbated by the Covid-19 pandemic, has made athleisure a wardrobe staple. Remote work culture even led many to ditch shoes altogether. In the tech industry, t-shirts and sneakers reign supreme, while sneakerheads fuel the booming market for iconic basketball shoes. Affordable flip-flops and easy-to-wear options cater to the need for simplicity and ease – and can even be found at your local convenience store. Despite varied preferences, fit and comfort unite all consumers, making them the top criteria in footwear purchases. For industry leaders, adapting to this trend is essential to stay ahead in the market.

In Simon-Kucher's new report, “The Footwear Industry: Consumer Priorities & Industry Insights,” analysts explored key trends and purchasing behavior across the footwear industry, including top categories of shoes, who’s buying them, and what footwear brands can learn from evolving consumer preferences in 2024.

See here for the full report and methodology.

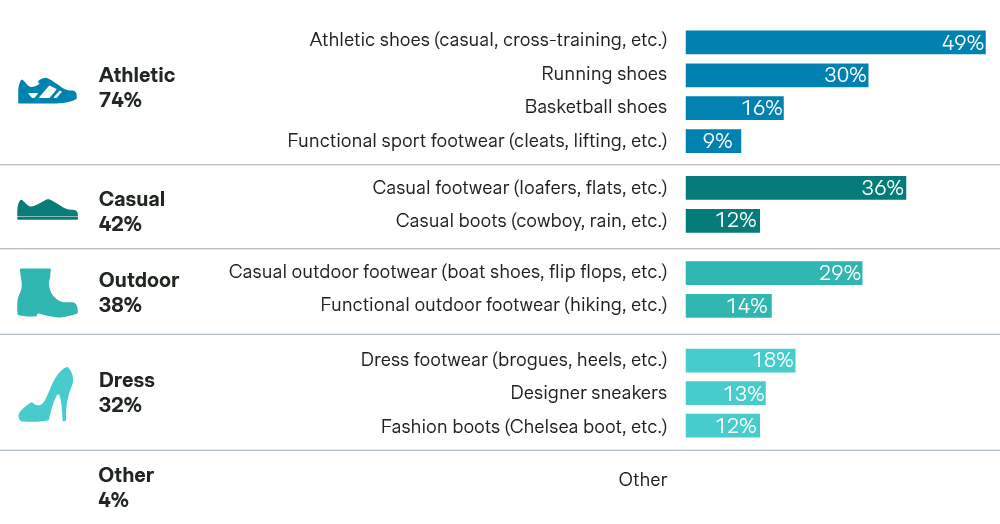

Top shoe categories in 2024

- Athletic – 74%*

- Casual – 42%

- Outdoor – 38%

- Dress – 32%

- Other – 4%

*Respondents could select multiple answers.

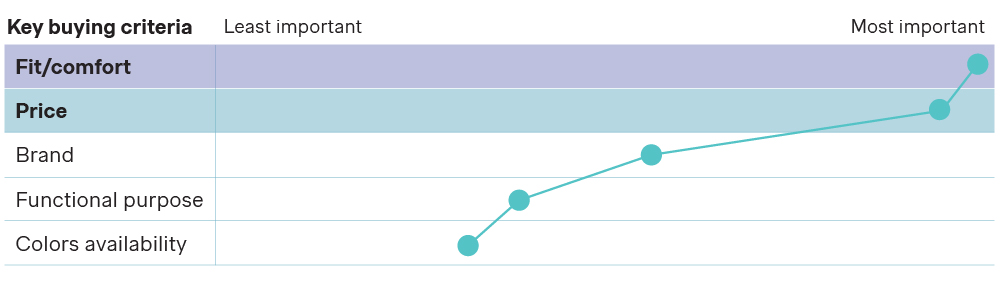

Top Shoe Criteria? Fit & Comfort

- Fit/comfort

- Price

- Brand

- Functional purpose

- Color availability

- Selection

- Product availability

- Promotions

- Sustainability

- Silhouettes/styles

- In-store experience

- Replacement

- Online experience

- Personalization

- Customization

- Ethically sourced

The parameters guiding consumer choices have evolved markedly, with an unmistakable tilt towards comfort and fit. Consumers prioritize "Fit/Comfort" as the most important criterion when purchasing footwear, even above price, indicating that while price sensitivity remains significant, the demand for well-fitting and comfortable shoes has surpassed it. Additionally, factors like brand, functional purpose, and color availability also influence purchasing decisions, but to a lesser extent.

For footwear brands, the takeaway is clear: marketing messaging should emphasize fit and comfort as primary value drivers. Highlighting these aspects in marketing campaigns, product descriptions, and customer reviews can help attract and retain consumers. Effective strategies might include promoting ergonomic designs, using high-quality materials, and offering customization options to enhance fit and comfort. By focusing on these key consumer priorities, brands can better meet the evolving needs of today's footwear shoppers, ensuring their products stand out in a crowded marketplace.

Shoe Categories by Shopper Type

Shoe trends by age:

The main similarity across all generations is a strong preference for athletic shoes and casual footwear, with variations in secondary choices reflecting their lifestyle needs. Millennials and Gen X also favor running shoes and basketball shoes, for example, while the Silent Generation leans towards casual indoor and outdoor footwear.

While fit and comfort are the top priority when shoe shopping for nearly all consumers, Gen Z and millennial consumers place price above it. That said, comfortable and athletic shoes still clearly appeal to all groups.

Shoe trends by gender:

Fit and comfort are the top footwear purchase criteria for both women and men.

Similarly, athletic shoes and casual footwear are the top categories among all genders. However, women tend to favor casual footwear styles and have less interest in other specialty shoe types such as designer sneakers, functional sport and outdoor footwear, and basketball shoes than men do.

Shoe trends by household income:

Although fit/comfort is still a priority across all income levels, consumers with household incomes under $100,000 per year prioritize price over it.

Footwear categories that remain consistently popular across household income levels include: Basketball shoes, casual outdoor footwear (flip-flops, etc.), and functional outdoor footwear (hiking boots, etc.).

On the other hand, these categories tend to be slightly more popular among consumers of higher household income: Running shoes, athletic shoes, dress shoes, casual footwear (loafers/flats, etc.), fashion boots, functional sport footwear, and designer sneakers.

See more demographic footwear consumer preferences here.

Where Consumers Buy Different Footwear Types

- Most likely to buy online: Functional sport footwear, Casual boots, Designer sneakers

- Least likely to buy online (compared to in store): Athletic shoes, casual footwear

- About equally as likely online vs. in store: Running shoes, Dress footwear, Functional outdoor footwear, Casual outdoor footwear, Basketball shoes, Fashion boots

Buyers of athletic and casual shoes tend to prefer a physical store experience, underscoring the importance of tactile experiences in consumer decision-making processes. Still, online retailers attract countless shoe shoppers, offering choice, easy price comparison, and increasingly fast shipping.

Market Insights: Decoding the Comfort Craze

The surge in consumer inclination towards comfortable footwear has transformed the footwear industry. This trend, deeply influenced by societal shifts and lifestyle changes, particularly the widespread adoption of remote work and education, and general increase in online shopping and social engagement, signifies a broader demand for products that blend functionality with everyday comfort and style.

How can footwear brands take consumers’ prioritization of fit and comfort and build better strategies?

Updating the portfolio: For footwear executives, understanding this comfort craze is essential. It emphasizes the importance of aligning assortment through product development and category extensions/franchises with consumer desires for shoes that offer both comfort and aesthetic appeal. Engaging in meaningful dialogues with consumers, leveraging their feedback, and implementing data-driven design innovations can help brands align more closely with consumer expectations on products that will resonate.

Product-market fit: The demographic divergence in footwear purchasing patterns underscores the importance of targeted marketing. Creating product lines at appealing price points without compromising on comfort can attract Gen Z and millennial consumers. Meanwhile, appealing to the comfort-seeking tendencies of older demographics requires innovation in materials and design that prioritize well-being and ease of use.

For brands, investing in technologies and materials that elevate the comfort and fit of their offerings is crucial. This means catering to the specific needs and preferences of different consumer segments and ensuring accessibility while maintaining quality and comfort. Engaging with younger consumers through digital platforms and aligning with their values can enhance brand loyalty and drive sales.

Omnichannel strategy: An omnichannel approach is non-negotiable in today’s retail landscape. Brands must seamlessly integrate online and offline experiences to cater to consumer preferences for both in-person and digital shopping journeys. Emphasizing personalization and customer engagement across all channels will enhance the consumer experience, fostering loyalty and driving sales.

In-store experiences remain vital for athletic and casual shoes, where fit and comfort are paramount. Consumers value the immediacy and personalization of in-store shopping, from trying on various sizes to feeling the material firsthand. For footwear executives, this signifies the enduring relevance of brick-and-mortar stores in providing a tangible connection between their products and consumers.

Conversely, the digital sphere has emerged as a preferred marketplace for specific footwear categories, such as functional sport footwear, casual boots, and designer sneakers. The online retail ecosystem offers a broader reach, enabling brands to tap into niche markets and cater to specific consumer segments with tailored digital marketing strategies.

Navigating evolving consumer preferences within the footwear industry necessitates a strategic recalibration for brands aiming to capitalize on the comfort and casual wear trends. Executives must harness in-depth consumer insights and demographic data to forge strategies that resonate with today’s diverse buyer groups. A pivotal strategy involves the nuanced balancing of quality, price, and comfort to meet the intricate demands of various consumer segments, particularly those younger generations that value affordability alongside comfort.