Shoe preferences and purchasing habits vary widely, as consumers have countless options available both online and in stores, and many challenge traditional assumptions. For example, contrary to popular tropes, shoe shopping is not predominantly driven by women. Further, despite being the most price-conscious demographic, younger consumers still outspend older generations on footwear. These variances, among many others, point to a complex landscape with many influences on consumer spending habits and preferences.

In Simon-Kucher's new report, “The Footwear Industry: Consumer Priorities & Industry Insights,” analysts unpacked data about consumer spending and preferences in footwear to understand how different consumer segments – notably different age groups, genders, and income levels – shop in 2024. These insights are crucial for industry executives looking to align their strategies with evolving consumer behaviors and maximize their market impact.

See here for the full report and methodology.

Gender: Men Buying More Shoes & Spending More on Footwear than Women

Quantity & type of shoe

Perhaps contrary to pop culture tropes, men were the greater purchasers of more shoes in the past year: 42% said they bought 3 or more pairs of shoes including 11% who bought 6 or more pairs compared to the 39% of women who bought 3 or more pairs of shoes including 9% who bought 6 or more pairs.

Men have higher preferences for designer sneakers, functional sport and outdoor footwear, and basketball shoes. Women have greater preferences for casual indoor and outdoor footwear and fashion boots.

Where they shop

Men tend to prefer buying directly from brand stores (and their websites) more than women do, while women prefer off-price retailers, value fashion stores, and superstores more than men do.

Purchasing criteria

While fit/comfort, price, and brand are still the top criteria for both women and men, the genders have slight preferences among some other criteria. For example, men care more about product availability, sustainability, and online experience than women do; women, on the other hand, care more about available colors, promotions, and silhouette styles than men do.

Spend

Men said they spent an average of $295 (15% above average) on footwear while females spent $217 (15% below average).

Women plan to cut back essential spending more than men do; 36% of men and 25% of women plan to increase essential spending in the next 12 months, while 15% of men and 21% of women plan to reduce essential spending. About half of all consumers anticipate no change in essential spending.

Women plan to cut back discretionary spending more than men do; 27% of men and 19% of women plan to increase discretionary spending in the next 12 months, while 24% of men and 31% of women plan to reduce discretionary spending. About half of all consumers anticipate no change in discretionary spending.

Women are more willing to search for a deal when faced with a price increase. Just 24% of women would still purchase the footwear, while 66% would seek a sale, discount, or less expensive brand or shoe; 10% would delay their purchase. On the other hand, when faced with the same price increase, 34% of men would still purchase, while 54% would seek a sale, discount, or less expensive brand or shoe; 11% would delay their purchase.

Age: Younger Generations Want Quantity AND Deals

When it comes to what kinds of shoes they like and how much they’re willing to spend, consumers of different ages vary widely.

Quantity & type of shoe

Millennials* are the largest buyers of multiple pairs of shoes of any age group. In the past year, while an average of 10% of consumers bought 6 or more pairs of shoes, Gen Z (14%) and millennials (17%) topped these figures. In fact, nearly half of Gen Z (47%) and more than half of millennials (57%) said they bought 3 or more pairs of shoes in the past year.

Younger shoppers have the greatest interest in basketball shoes and designer sneakers of any age group, while older generations demonstrate relatively little variety in shoe category interest; they mostly purchase athletic shoes and casual footwear and have the least interest in dress shoes.

Where they shop

All generations prefer to buy their footwear from online retailers more than any other store, but Baby Boomers and Millennials prefer it the most. Millennials are most likely to buy footwear from superstores like Target and Walmart; 35% said they shop here compared to 26% or less of other generational groups who said the same.

Purchasing criteria

While fit/comfort are the most important criteria for consumers overall, price is more important among Gen Z and millennial consumers. Fit/comfort remain the second-most important, and price is secondary for all older generations.

Spend

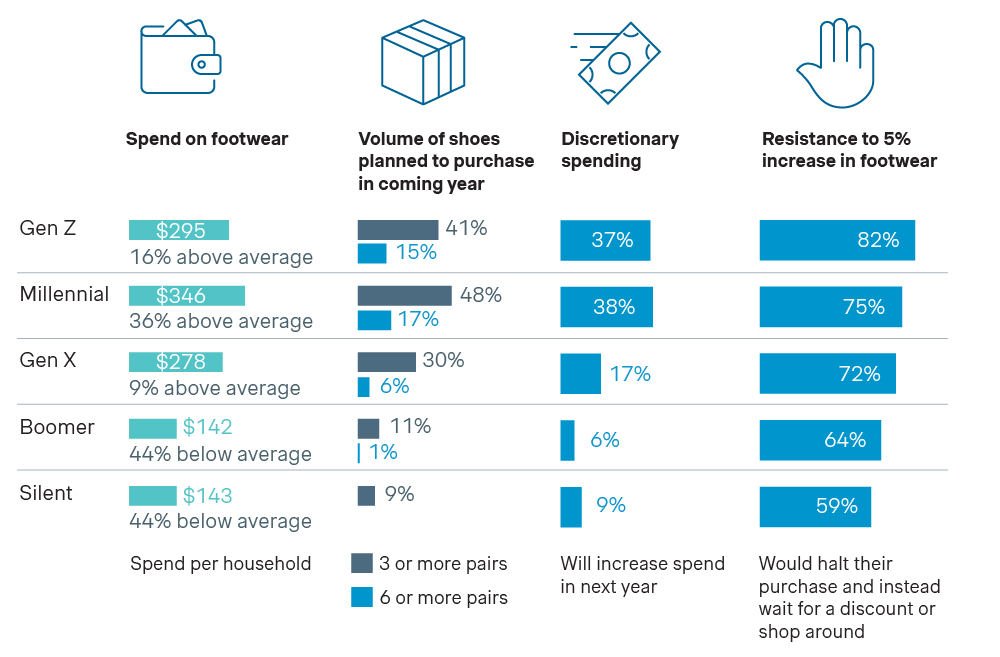

Roughly half of all Gen Z (48%) and millennials (51%) said they have noticed price increases that were more than they expected in the past year, while fewer older generations did so, and youths were even more price-sensitive and willing to shop around for deals than their older counterparts. Curiously, younger generations plan to increase discretionary spending, buy more shoes, and spend more on shoes in the next 12 months than older generations.

Annual footwear spend:

- Gen Z: $295 (16% above average)

- Millennial: $346 (36% above average)

- Gen X: $278 (9% above average)

- Baby Boomers: $142 (44% below average)

- Silent gen: $143 (44% below average)

Essential spend: Although all age groups plan to maintain or increase essential spending – no one is cutting back on essentials – Gen X and older consumers plan to maintain essential spending with no more than 28% increasing essential spending, whereas 41% of Gen Z and 44% of millennials plan to increase essential spending in the coming year.

Discretionary spend: Only 25% of Gen Z and 24% of millennials plan to reduce discretionary spending, as opposed to 29% of Gen X, 32% of Baby Boomers, and 28% of the Silent Generation. 37% of Gen Z and 38% of millennials will increase discretionary spending in the coming year, as opposed to 17% of Gen X, 6% of Baby Boomers, and 9% of the Silent Generation.

Price sensitivity and deal seeking: 82% of Gen Z would halt a footwear purchase for a 5% price increase, higher than 75% of millennials, 72% of Gen X, and roughly 60% of Baby Boomers and Silent Generation consumers who would. Instead, Gen Z said: 30% would wait for a discount, 16% would look for footwear on discount websites, 16% would look for a cheaper brand, 11% would delay their purchase, and 9% would shop for a different shoe entirely. On the other hand, 40% of Baby Boomers and Silent Generation consumers would wait for a discount on their shoes rather than shop around or change their shopping plans.

Further, younger generations have high expectations for shipping. While 62% of Gen Z and 69% of expect their order shipped their home within 2 days or fewer, no more than 50% of Gen X and older consumers share this expectation; the majority of older generations consumers are fine with shipping in 3-5 business days or fewer.

Household Income: How Buyers Balance Price & Preferences

Quantity & type of shoe

In the past year in households with incomes over $75,000, roughly half of consumers (45% or more) bought 3 or more pairs of shoes, compared to roughly 30% of households with incomes under $75,000.

Higher income households are also the greater buyers of athletic shoes, designer shoes, functional sport footwear, casual footwear, dress footwear, and fashion boots compared to lower income households. When it comes to basketball shoes, casual outdoor footwear, and casual boots, however, consumers of all household income levels appear to share a more balanced interest.

Where they shop (and how that’s changing)

Online retailers like Amazon and Zappos are still the top footwear source for consumers of all income levels. However, some budget-conscious consumers plan to shift their dollars in the year ahead.

Consumers with lower household income plan to reduce their footwear purchases from online retailers by 8% (HHI group <$25K) and 7% ($25-50K) in the next year and instead increase footwear purchases from budget department stores 11% (<$25K) and directly from brand stores 7% (<$25K) and 8% ($25-50K) and their websites.

Consumers with higher household income plan to reduce their footwear purchases from superstores by 11% ($150-200K) in the next year and instead increase footwear purchases from budget department stores, value fashion stores, and directly from brand stores 5% each.

Interestingly, consumers with the lowest household income plan to increase their footwear purchases from luxury department stores by 5% while the highest income group plans to decrease their footwear purchases there by 3%.

Purchasing criteria

Price is more important than fit/comfort among consumers with a household income under $100,000.

Spend

Annual footwear spend by household income level

- Less than $25,000 - $125 (51% below average)

- $25,000 -- $49,999 - $181 (29% below average)

- $50,000 -- $74,999 - $193 (24% below average)

- $75,000 -- $99,999 - $215 (16% below average)

- $100,000 -- $149,999 - $335 (31% above average)

- $150,000 -- $199,999 - $337 (32% above average)

- $200,000 or more - $446 (75% above average)

Discretionary spend: Roughly 1/3 of consumers (32% or more) with household income under $75,000 plan to reduce discretionary spending in the year ahead, compared to 25% or less of consumers with higher household income. Most groups plan to maintain discretionary spending with no change, but roughly 1/3 consumers with household income over $100,000 plan to increase it.

Price sensitivity and deal seeking: Roughly 80% of consumers across all income levels said they noticed price increases over the past year. How great an increase they noticed also varied with no correlation to income level.

Understanding and Targeting Customer Segments in the Footwear Market

Stay Up to Date on Changing Consumer Preferences

To stay relevant, footwear industry executives must continuously monitor and adapt to changing consumer preferences. Utilizing tools like consumer surveys, social media listening, and data analytics can provide real-time insights into shifting trends. Regularly reviewing market reports and research, such as Simon-Kucher’s latest findings, can help executives stay ahead of the curve and make informed decisions.

Targeted Marketing Strategies

Effective marketing requires tailoring messages to resonate with specific demographic groups. For instance, emphasizing fit and comfort is crucial, as these are the top criteria for both men and women when purchasing footwear. Highlighting value through promotions and discounts can attract younger, price-sensitive consumers. Additionally, leveraging digital marketing strategies to reach Gen Z and millennials, who prefer online shopping, can enhance engagement and drive sales.

Enhancing Multi-Channel Visibility

Maintaining a strong presence across both online and offline channels is essential. Offering fast, free shipping can appeal to younger consumers who have high expectations for delivery times. Ensuring product availability and providing a seamless shopping experience across all platforms can help capture and retain a diverse customer base.

By focusing on these strategies, footwear brands can better navigate the complexities of the market, meet the evolving needs of different consumer segments, and drive sustainable growth in a competitive landscape.

*Survey respondent ages by generation:

- Generation Z: 18-27

- Millennial: 28-43

- Generation X: 44-59

- Baby Boomer: 60-78

- Silent Generation: 79+