The global economy encountered challenges in the last two years, including severe inflation on energy and resources, and rising interest rates, creating uncertainty in the business climate. Our B2B trends study reveals that business leaders anticipate ongoing uncertainty this year but remain positive.

This article provides guidance for leaders of B2B companies, offering insights and outlook for 2024 based on the perspectives collected from European business leaders.

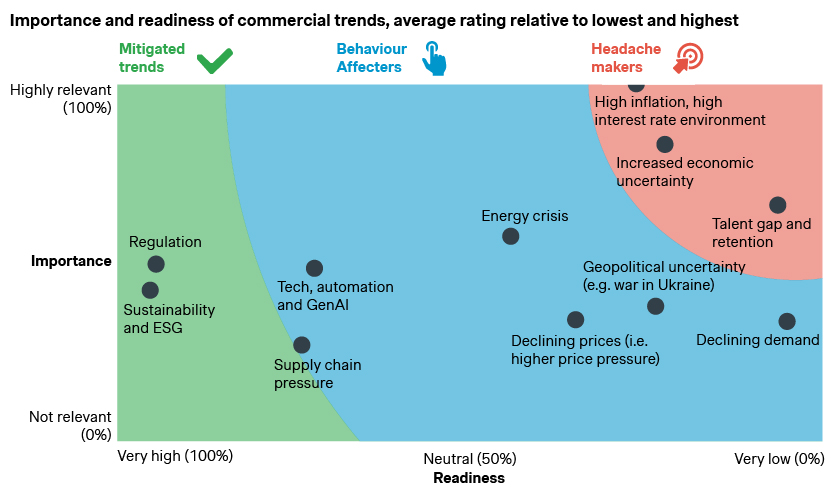

Market trends pose ongoing challenges for 2024

Looking at the macro-economic environment, the B2B Trends Study results provide three interesting insights.

Firstly, leaders of B2B companies indicate that core trends of 2023: High inflation and interest rates, increased economic uncertainty and the talent gap, are still prevalent. Most interestingly, business leaders also indicate that they are typically ‘not ready’ for these trends.

Secondly, some B2B companies claim to be unprepared for declining demand, geopolitical uncertainty, and increased price pressure, despite these trends being indicated as less relevant.

Thirdly, B2B companies seem to be prepared for trends carried over from 2023, such as technology, automation, Generative AI, sustainability and ESG, and supply chain pressure. However, their relevancy scores vary, categorizing them as mitigated or as factors affecting behavior.

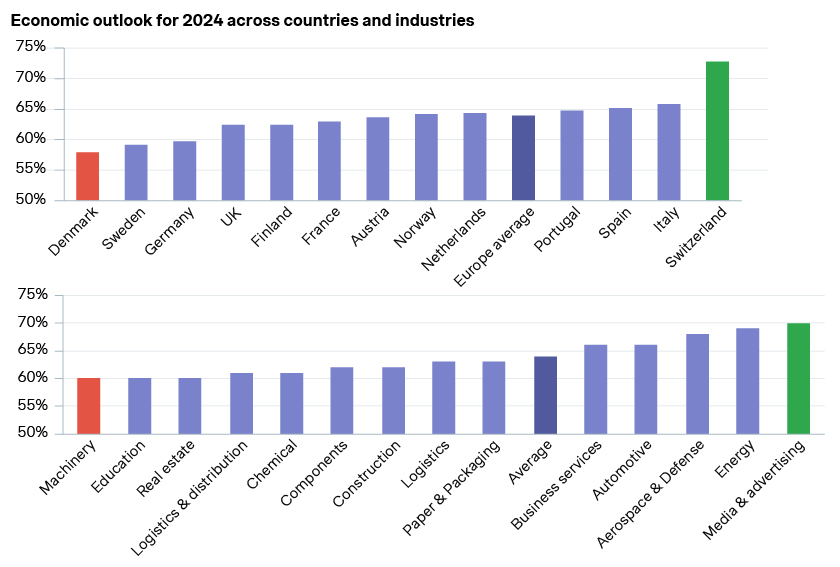

The economic outlook for 2024 is more positive than 2023

European companies generally express cautious optimism regarding the economic outlook for 2024, scoring an average outlook of 64%, a 10% increase compared to their expectations for 2023. Furthermore, four out of five business leaders anticipate stable or increasing profits in the coming year.

Swiss companies stand out as the most optimistic about 2024, whereas Denmark, Sweden, and Germany exhibit lower levels of optimism. Similarly, the energy sector and media & advertising companies are the most optimistic industries, while machinery, education, and real estate lag behind.

Notably, It’s notable that the positivity in European countries is much lower than in other regions: 64% in Europe vs 83% and 86% in the Americas and APAC respectively.

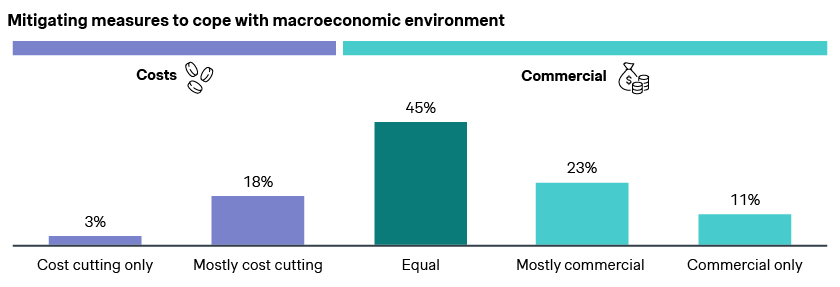

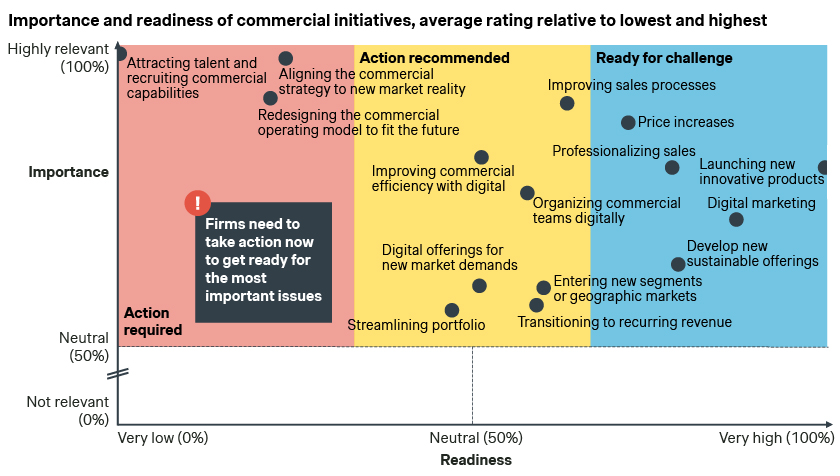

Commercial topics seen as powerful mitigation measures, but readiness is a concern

When asked if, and how companies plan to mitigate the challenges posed by the current macroeconomic environment to (re)gain profitability, 34% indicate that commercial levers are their main lever. An additional 45% indicate that commercial levers and cost cutting are equally relevant.

When asked what commercial initiatives are relevant to their business, they indicate that attracting talent and recruiting commercial capabilities is the absolute priority, followed closely by aligning the commercial strategy to the new market reality, redesigning the commercial operating model, improving sales processes and price increases. Unsurprising, as these initiatives, if successful, mitigate the three core challenges ‘headache maker’ challenges as previously discussed: High inflation and interest rates, increased economic uncertainty and the talent gap.

What is worrisome is that on average companies indicate their readiness for these initiatives to be low for some, and neutral for most. While companies indicate they are ‘somewhat ready’ when it comes to price increases, recruiting commercial capabilities and adjusting the commercial strategy prove to be more challenging for most.

Our short-term recommendations for 2024

Having seen the most relevant issues, business leaders could best take the following strategic measures

1. Align commercial strategy to new market reality

Since COVID-19 hit the globe in 2020 the business environment has continuously changed. While some companies have benefitted, many have not, and most are currently seeing a changed world. A thorough review of the commercial strategy to assess current and future growth opportunities is recommended.

2. Redesign commercial operating model to fit the future

The current talent gap is not a trend that is expected to fade away soon, so companies need to adjust. While attracting the right people should remain a priority, a redesign of the commercial operating model to increase sales efficiency and effectiveness can help.

3. Manage for profit

Organizations that prioritize resilience maintain an unwavering commitment to preserving margins. This article presents five essential strategic margin management measures often underestimated, enabling the expansion of profit margins even amid uncertainties and constraints in times of growth.

Manage for Profit Seminar

To assist business leaders in profit management for 2024, we are organizing an exclusive seminar on April 18 in Amsterdam, focused on strategic margin management. The Manage for Profit Seminar will delve into strategies for enhancing profits during potentially stable revenue periods. Hermann Simon will provide insights into today's challenges within the macroeconomic landscape. Our team of Simon-Kucher experts will offer commercial perspectives, and Air-France KLM will contribute practical insights, ensuring a comprehensive understanding of navigating profit growth in any business climate. You can find the complete program here.