The residential construction industry has entered 2025 with cautious optimism. Builders and contractors anticipate revenue growth, yet rising material costs, labor shortages, and affordability challenges continue to exert pressure on profitability. Our 2025 Construction and Building Materials Study reveals key trends shaping the industry and offers insights into how manufacturers and suppliers can adjust to meet changing customer needs.

Rising costs continue to squeeze margins and motivations

Despite expectations for revenue increases, pricing remains an underutilized lever in the industry. While seventy-six percent of respondents who anticipate growth believe volume expansion will be a driver, less than half of respondents indicate pricing actions will facilitate their revenue growth.

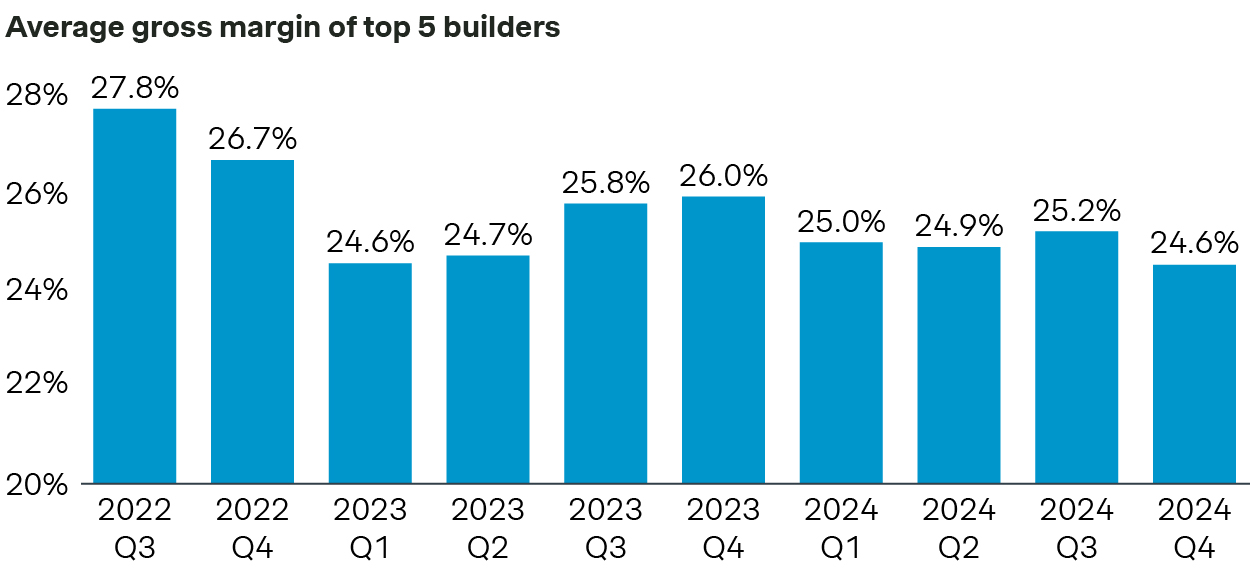

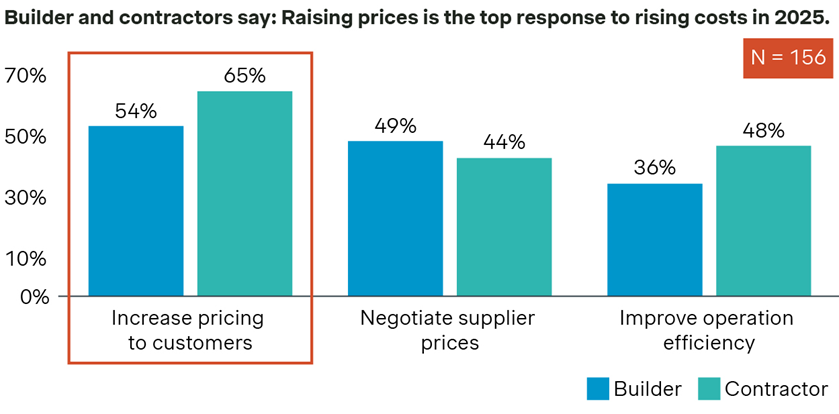

General contractors and remodelers are more likely to pass rising costs onto customers rather than absorb them, while residential builders often find themselves unable to do so following their recent return from historically high gross margins. For example, Lennar has already projected Q1 2025 gross margins to fall below 20%, highlighting the challenge of maintaining profitability without strategic pricing adjustments.

As a result, residential builders are more price-sensitive and will look to suppliers for solutions that help them protect their margins. Manufacturers and suppliers that offer value-engineered alternatives, pricing incentives, and materials that reduce installation costs will be better positioned to support this segment while maintaining their own profitability.

Home sizes are shrinking

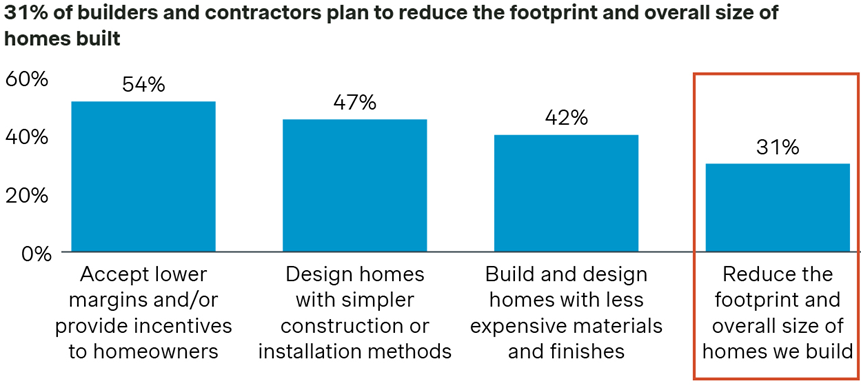

Affordability constraints are shaping market dynamics in other ways as well. The survey indicates that builders are responding in two key ways: first, many builders are downsizing. Those planning to reduce home footprints expect an average six percent cut in square footage, a clear move toward efficiency over excess. Builders are designing smaller homes to optimize costs while still meeting buyer expectations. Second, over half of builders surveyed indicated they are prepared to either absorb lower margins and/or offer buyer incentives to maintain affordability. Suppliers that provide space-efficient solutions and innovative materials to maximize functionality in smaller homes will be better aligned with builder needs.

Sustainability is on the agenda…but is not for everyone

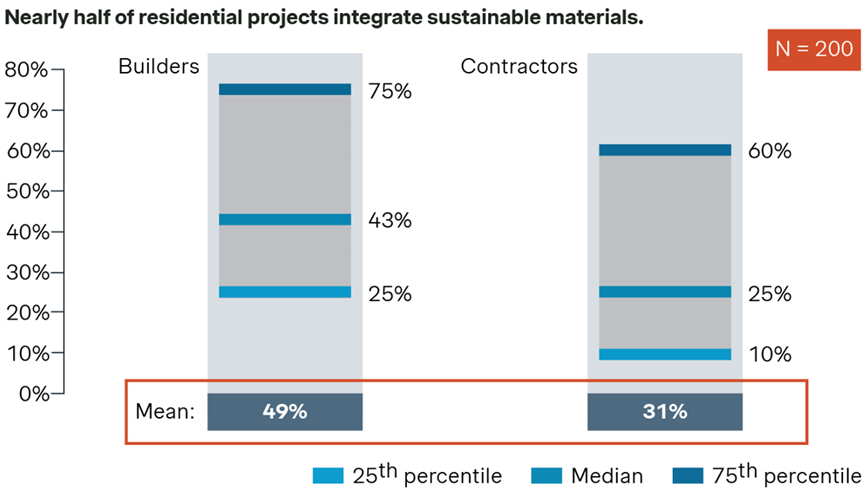

Nearly half of all residential projects now use sustainable building materials, signaling a strong and lasting demand for environmentally friendly solutions. However, builders are investing more in sustainable practices than contractors, with over 84% sourcing sustainable materials at least occasionally. Manufacturers and suppliers who offer high-quality, sustainable, and energy-efficient materials at competitive price points will have a significant opportunity to differentiate themselves in the market.

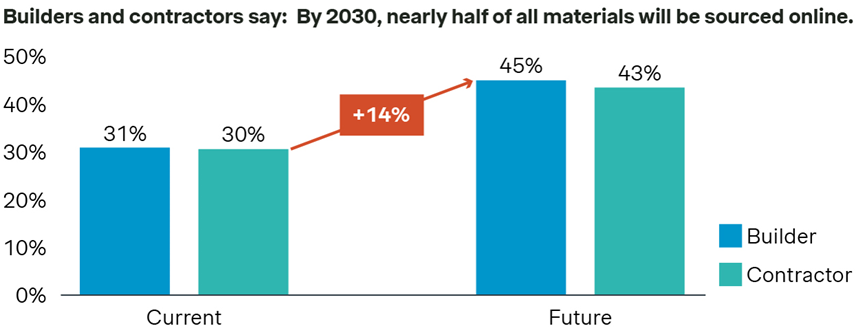

Digital purchasing is becoming the norm

Suppliers and wholesalers continue to make significant investments in digital/eComm capabilities and rightly so. Digital purchasing is rapidly becoming the norm in the construction materials industry. By 2030, builders and contractors expect to source nearly half of their materials online. However, while digital adoption is growing, hesitations remain. On Builder’s First Source’s most recent quarterly call, CEO, Peter Jackson cited “adoption” challenges while also recognizing their goal of $1BN in digital sales. Many buyers express concerns over order complexity, product availability, and the level of customer service provided through digital channels. Manufacturers and suppliers who wish to maintain a competitive edge must ensure a seamless online purchasing experience while continuing to offer the high-touch service their customers have come to expect. A well-integrated omnichannel approach that combines digital convenience with responsive customer support will be essential in winning market share.

Brand loyalty remains strong, but service matters more than ever

Loyalty remains a defining characteristic of the construction materials supply chain. The survey reveals that ninety-three percent of builders and contractors consistently purchase from their preferred suppliers. However, this loyalty is contingent on more than just price. Reliability in supply chains, product availability, and strong customer service are paramount in maintaining these long-standing relationships. Price volatility, extended lead times, and inconsistent service continue to be key pain points for builders and contractors. Manufacturers and suppliers that can offer stable pricing, dependable inventory, and superior customer support will be better positioned to retain and expand their customer base.

How manufacturers and suppliers can win in 2025

- Take a segmented approach to pricing: With impending tariffs, suppliers will undoubtedly take price in 2025. However, a price increase strategy should account for different levels of price sensitivity with contractors/remodelers demonstrating the ability to push prices through to their end-customers. New construction builders on the other hand, are likely to resist pricing pressures from professional procurement teams and are already facing shrinking profit margins.

- Sell on value, not just price: Manufacturers and suppliers must adequately differentiate their messages and value proposition. For example, contractors care greatly about installation efficiency more than builders as this driver eats more into their margins.

- Align with your customers’ business needs: Especially for contractors, your products and solutions should be oriented towards how they can make money and grow their business.

- Update your value calculators: COVID enabled the industry to sell on availability but now we must sell on value. Inputs such as labor efficiency, defect rates and warranty costs should be fully measured and accounted for.

- Ensure a seamless digital experience: Time savings is the most cited reason for digital adoption. An added benefit of digital adoption? An analysis of a recent large distributor found digital orders exhibited gross margins a full 100 basis points higher than traditional orders.

The bottom line: Suppliers who thrive in 2025 will be those who meet their customers where they are, not just with great products, but with pricing, service, and solutions that help them run better businesses.

Form placeholder. This will only show within the editor